On 2 December 2024 the Lord Chancellor, Shabana Mahmood, announced that the Personal Injury Discount Rate (‘PIDR’) for England and Wales will be 0.5% from 11 January 2025. This brings England and Wales into line with the rate recently set in Scotland and Northern Ireland.

As expected, the Government Actuary's Department ('GAD') recommended a single rate after all, despite extensive consultation in the 2023 and 2024 Calls for Evidence. GAD’s conclusion is brief:

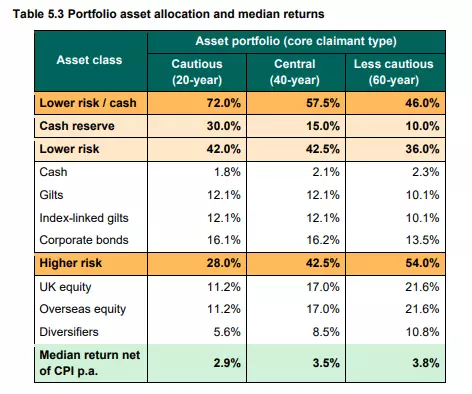

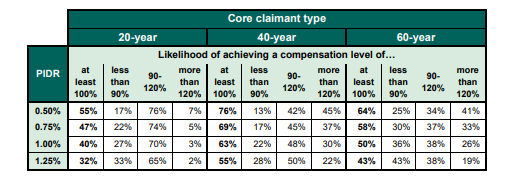

As far as the rate itself is concerned, GAD adopted a very different approach to that in 2019 when it modelled the return on a 43 year, notional investment portfolio and then made deductions for inflation, tax, expenses and a margin of prudence. On this occasion, GAD has modelled the returns on 20, 40 and 60 year terms, adopting a different investment portfolio and different tax and expenses assumptions for each group. A comparison was then made of the likelihood of achieving sufficient compensation for each of these groups at different discount rates. GAD concluded that the acceptable range of rates was 0.5% to 1.0%.

The Lord Chancellor adopted 0.5% on the basis that all three groups would have at least a 55% chance of receiving full compensation and no more than a 25% chance of under-compensation. This had the unavoidable effect of meaning that two of the three groups have at least a 40% chance of over-compensation.

Return on investment

One of the most significant changes is in relation to the approach to calculating the return on investment. GAD worked on the basis that each of the three modelled groups would have a different attitude to investment with the 20, 40 and 60 year investor adopting either a cautious, central or less cautious approach. Having regard to actual investments by claimants, GAD also adjusted the asset split by allowing for the reality that claimants tended to hold greater cash reserves than had previously been assumed to be the case.

Inflation

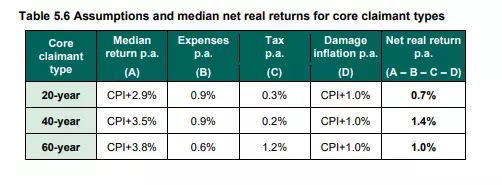

GAD has assumed that claimants are subject to both price and earnings inflation. Price inflation was taken as being CPI and earnings inflation assumed to be between 1.25% and 1.5% above CPI. Whilst noting that 65-85% of damages are earnings, GAD concluded that the appropriate deduction for damages inflation was 1% above CPI. That is the same deduction as on the last review in 2019.

Tax and expenses

The deductions for tax and expenses was found to vary according to each of the investor types, being 1.2% at 20 years, 1.1% at 40 years and 1.8% at 60 years.

Return after inflation, tax and expenses

The net returns after inflation, tax and expenses can be found in table 5.6 of GAD’s report.

Adjustment for risk of under-compensation

On the last review in 2019, a deduction of 0.5% was made to the return to reduce the risk that a claimant was under-compensated. The same deduction was adopted in Scotland and Northern Ireland.

However, as GAD has adopted three different investment portfolios each producing a different return, it had to consider the appropriate deduction by looking at the impact on each of the three scenarios. This is set out in the Summary of single rate advice on page 10.

Under compensation was considered as the claimant receiving less than 90% compensation. Over-compensation was deemed to be the claimant receiving more than 120% of compensation (20% over compensated). The final conclusions based on this table are also set out on page 10:

As a discount rate of +1.25% does not meet the claimant’s needs, GAD concluded that the appropriate discount rate should be between 0.5% and 1.0%. The Lord Chancellor could have chosen a rate at or between those figures but has decided to err on the side of caution and adopted 0.5%. In effect, this is the same as averaging the return of the three different portfolios, producing a headline rate of 1.0% and taking 0.5% off as the margin of prudence. Despite the complicated analysis, ultimately, the margin of prudence appears to be broadly the same as in 2019.

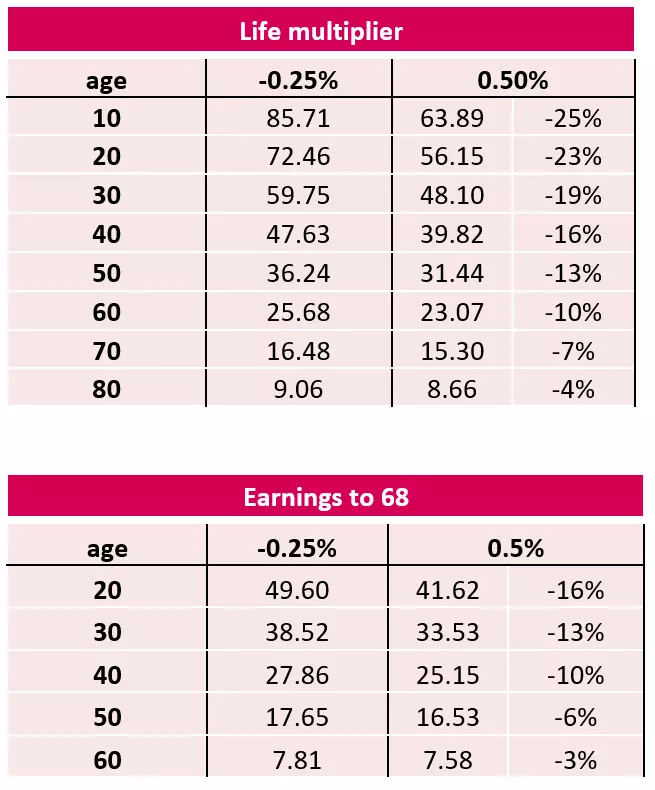

Effect on multipliers

The move to a positive discount rate is a +0.75% swing and reduces multipliers fairly significantly. Inevitably, the effect increases according to age.

Conclusions

GAD has surprised us once again by abandoning what had become a fairly standard approach of modelling the return on a notional portfolio over a 43 year period and making deductions for tax, expenses and inflation. On this review, GAD has estimated the return of three different portfolios each over a different investment period and adopted different assumptions as to the effect of tax and expenses on each group. This produces three possible discount rates of 0.7% for 20 years, 1.4% for 40 years and 1.0% for 60 years.

The returns at the two extremes of the range are significantly lower than the central group. The return at 20 years is only 0.7% and even at 60 years it is only 1.0%, largely because the impact of tax jumps nearly 1% to halve the return. These two lower rates reduce the discount rate as more scenarios then fall into the under-compensation category.

If GAD had only adopted the 40-year net return of 1.4%, the likely discount rate would have been 1%, after the equivalent reduction of 0.5% to reduce the risk of under-compensation.

Compensators are likely to feel frustrated that the new approach reduces the headline rate by 0.5% and that the Lord Chancellor chose the most prudent of the three possible options given to her. Conversely, we may feel relieved that the deduction for damages inflation was kept at 1% above CPI. Claimant advisers may seek to challenge this assumption just as they have challenged the inflationary assumption adopted in Scotland and Northern Ireland. On the whole, both sides may feel slightly aggrieved or relieved in equal measure. What we do have, for the first time in seven years, is a consistent discount rate across the three jurisdictions and, with a positive rate, an actual discount.

For further information contact Michael Renshaw, Head of the Discount Rate Group