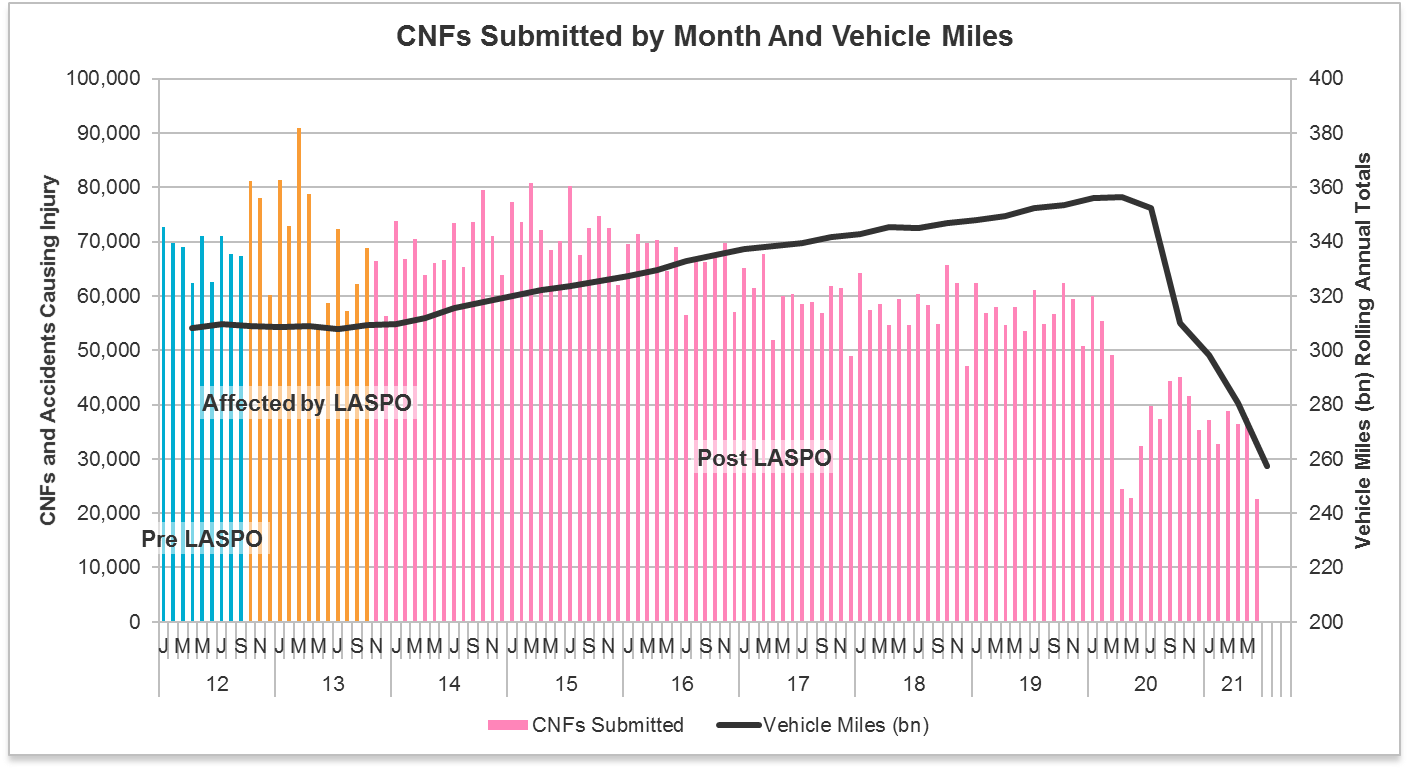

The first release of portal data after the launch of the new Official Injury Claims portal is noteworthy for the reduction in CNFs, but as yet we don't have any corresponding data from the OIC to assess the overall picture.

That makes it more difficult to assess the impact of the reducing lockdown requirements on claims in RTA but there is no doubt traffic is increasing and claims departments are starting to feel that increase alongside the implementation of new working practices.

As well as the portal data, we also have the CRU annual performance data, which shows cases registered to CRU from April 2020 to March 2021, the Department of Transport's recently published Personal Injury Accident Statistics on Public Roads for 2020, our usual roundup of transport and footfall statistics, and a review of other industry developments.

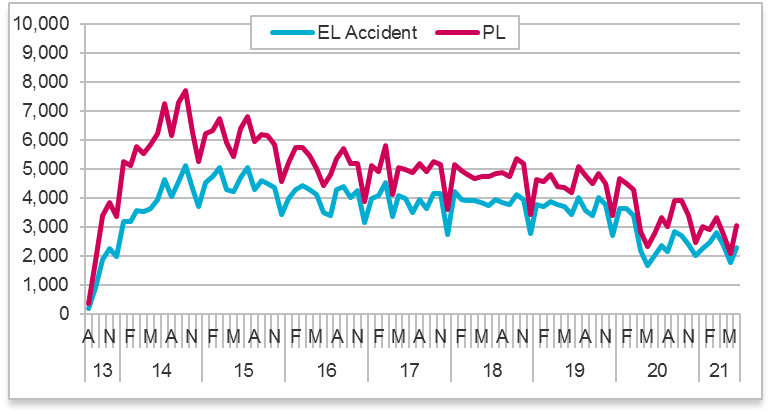

The number of RTA claims registered to the portal is affected by the 'go live' of the new OIC, and we analyse the position so far in the new claims environment. EL and PL volumes appear more buoyant, however.

OIC Portal news and developments so far

There has been no formal data release from the OIC as of yet, and we gather the first release of such data may be delayed to September. Whilst frustrating, one can understand the MOJ's reluctance to release data yet in case people start to draw conclusions based on skewed data. So what do we know so far…?

Certainly reported volumes of new claims since 31 May 2021 are well down, whether in the OIC or the existing RTA Portal. However a large part of that seems to be due to some early teething issues on the part of some major players in the claimant personal injury market. Admiral and Carpenters have been among the frontrunners, but a number have yet to join the party and once they do we should start to get a greater feel for overall volumes as well as behaviours.

Whilst there are a number of unrepresented claimants using the portal directly outside the usual third party assistance schemes, volumes are very small as expected given the lack of consumer awareness of the new process and the difficulties it throws up. There are also only a very small number of CMCs submitting claims directly at present.

Reports are of very high volumes/percentages of "additional injuries" outside whiplash identified on the SCNFs, however it is too soon to see many medical reports to assess if that is going to translate into substantive claims for non-whiplash injuries.

Similarly, there are high volumes of claims on the SCNF for "exceptional circumstances" but again it will only be once medical reports start to come through that we will understand if these are really being pursued. Interestingly so far it is not just unrepresented claimants alleging exceptional circumstances.

Finally, some "teething problems" are being corrected by a couple of updated releases from the MIB this month which will incorporate changes to the process for re-allocating claims between insurers reflecting the ABI MOU put in place, and some more general changes to minor defects identified so far.

News in brief

Green Cards: the EU's decision on 30 June to waive the obligation for drivers from the UK to show the motor insurance Green Card was warmly welcomed as a pragmatic approach, particularly for Northern Irish motorists crossing the border into Ireland.

Lugano Convention: on 1 July, the Federal Department of Foreign Affairs (FDFA) of Switzerland, in its capacity as Depository of the Lugano Convention, announced it had received a Note Verbale from the European Commission saying it is not able to give its consent to invite the UK to accede to the Lugano Convention. The ultimate decision on Lugano appears to rest with the European Council, and the final decision is awaited. In the meantime, the Justice and Home Affairs Committee has written to the Lord Chancellor setting out its concerns that the UK may be barred from acceding to the Convention, and asking a number of questions to be responded to by 27 August. These include seeking confirmation that the European Council is due to make its decision when it next meets in October.

Vnuk: a DfT statement on 29 June comments on the legislative changes needed to remove the effects of Vnuk, which would require a wider range of vehicles than those such as cars and motorbikes to be insured, including ones previously not requiring insurance, such as golf buggies, mobility scooters and quad bikes, from British law. The DfT says it "will continue to explore bringing forward the necessary legislation as soon as parliamentary time allows" and will "follow with interest" passage of the Private Members' Bill Motor Vehicles (Compulsory Insurance) Bill introduced on 21 June.

In Europe, the Council and European Parliament have reached agreement on the amendments to the Motor Insurance Directive. The provisionally agreed text amends the scope of the directive including new definitions of ‘vehicle’ and ‘use of vehicle’. It also provides member states with new possibilities for national derogations from the insurance obligation. The use of a vehicle in motorsport events and activities will be excluded from the directive, provided that there is alternative insurance. The Parliament and the Council are expected to adopt the directive in the autumn. Once it has been signed and published in the Official Journal of the EU, the text will be transposed into national law within 24 months from the date of entry into force.

E-scooters: at the end of last month, Admiral published details of the number of e-scooter accidents reported to them from 2017 to 2021, highlighting a spike in numbers for the first half of 2021 in comparison with previous years, and warning that "this could just be the tip of the iceberg".

Compulsory ADR: on 12 July, the Civil Justice Council published its report on compulsory alternative dispute resolution. In January 2021, the Master of the Rolls had asked the CJC to report on the legality and desirability of compulsory ADR. The report concludes that mandatory (alternative) dispute resolution is compatible with Article 6 of the European Human Rights Convention and is, therefore, lawful.

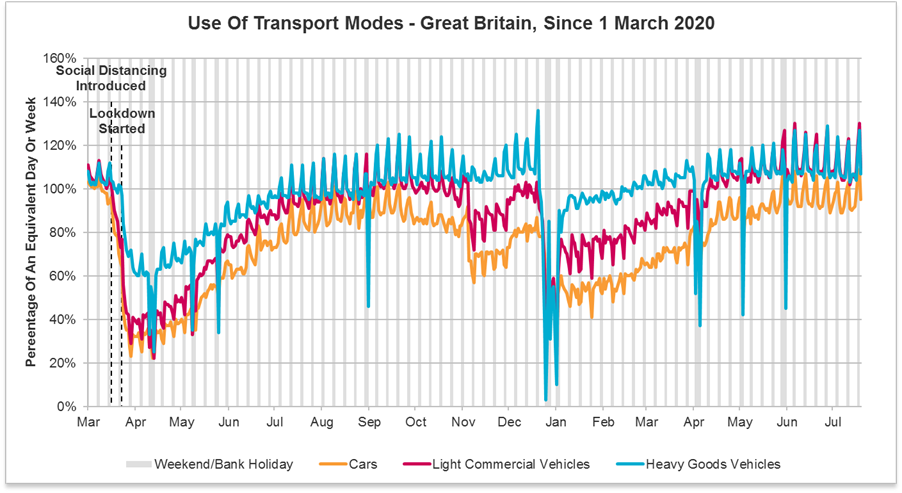

Use of Transport

Traffic levels are pretty much at or slightly over the normal figures before lockdown and it may be this becomes less of a feature of future monthly updates as we return to business as usual. Of course, if there are major dips or rises we will return to this very important topic in future. Hopefully we can incorporate e-scooters when they are inevitably given the green light after trials and looking further into the future, the number of automated vehicles on our roads.

The figure for combined transport on the road during the week is at about 95% of pre-covid levels, with private vehicle use still lower than commercial vehicles. At weekends combined road transport is at around 115% of normal however it should be borne in mind that "normal" in this context was an average of the Feb 2020 figures, which themselves fluctuated between midweek and weekends, and in Feb 2020 people were a lot less likely to be staycationing:

There is a slight rising trend in terms of public transport but it remains a slow transition. National Rail is currently at around 45% of normal in the week, 55-65% at weekends.

Road Casualties during the lockdown – data released

At the end of June, the Department for Transport released its reported road casualties for Great Britain provisional results for 2020.

These statistics show:

- an estimated 1,472 reported road deaths in 2020 which includes a total of 4 months of full national lockdown (April to June and November) as well as affected months generally, a decrease of 16%

- EU countries showed a 17% reduction so very similar

- an estimated 23,486 killed or seriously injured (KSI) casualties in 2020, a decrease of 22% compared to the same period in 2019

- 115,333 casualties of all severities in 2020, a decrease of 25% from 2019

- Interestingly pedal cyclist casualty rates saw the greatest percentage decrease (34%) compared to all other road user types although some months (Aug, Sept, Dec) showed an increase in injury claims and fatalities rose by 40%

- April 2020 was the month with the most reduction overall, with a 68% reduction in all injuries and 41% on fatalities.

Footfall and Economic Data - ONS

UK businesses are reporting a change in working patterns with 11% of the workforce (of employers that responded) moving from furlough or fully at home working to a hybrid model.

In the latest week to 10 July 2021, overall retail footfall was at 74% of the level seen in the equivalent week of 2019. Comparing retail locations, in the same week, footfall at retail parks was at 96% of its level in the equivalent week in 2019, whereas the corresponding figures for shopping centres and high streets were 69% and 67%, respectively

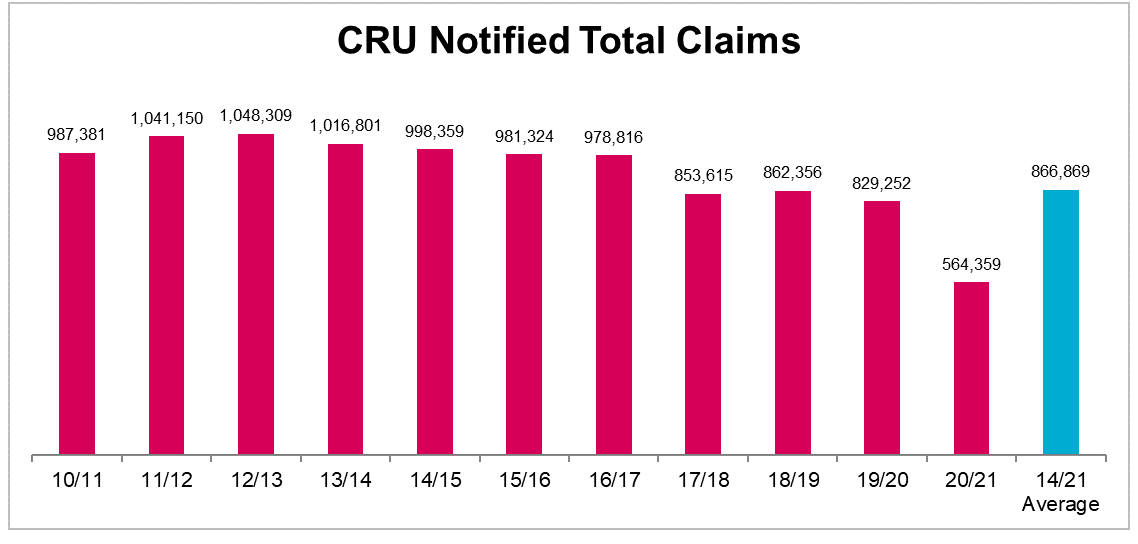

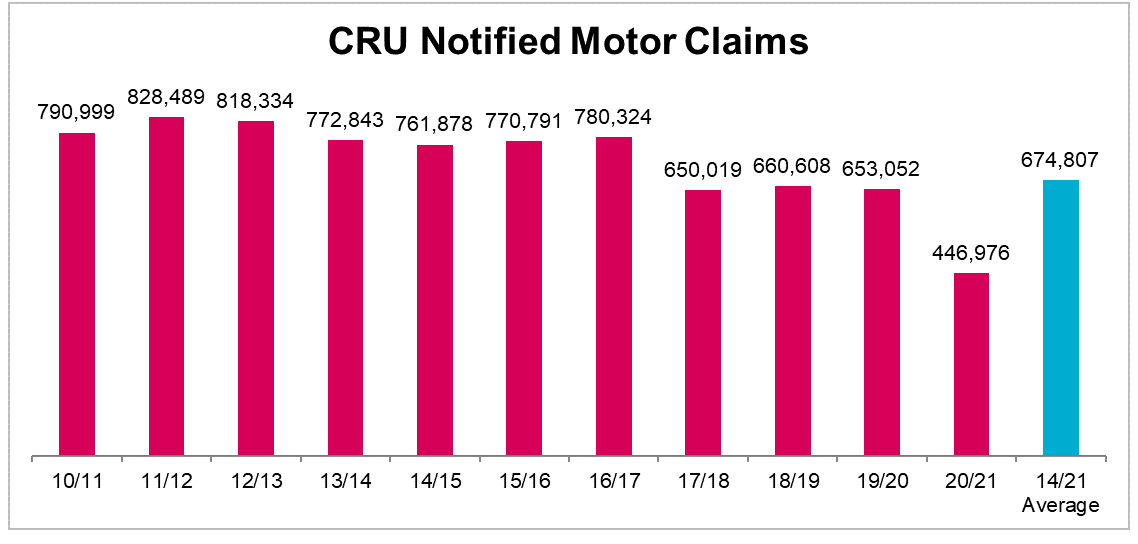

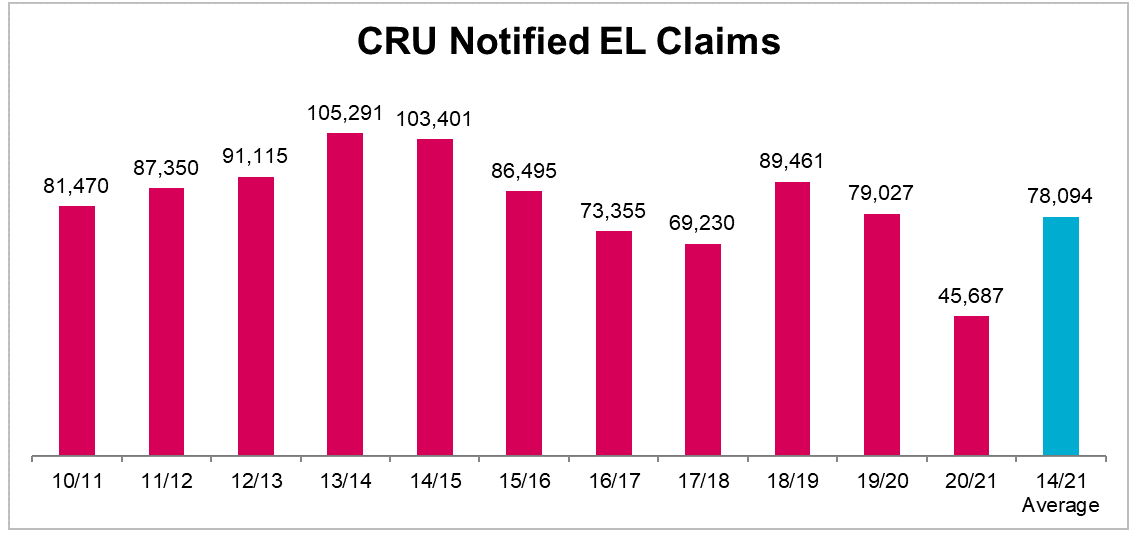

Compensation Recovery Unit Statistics

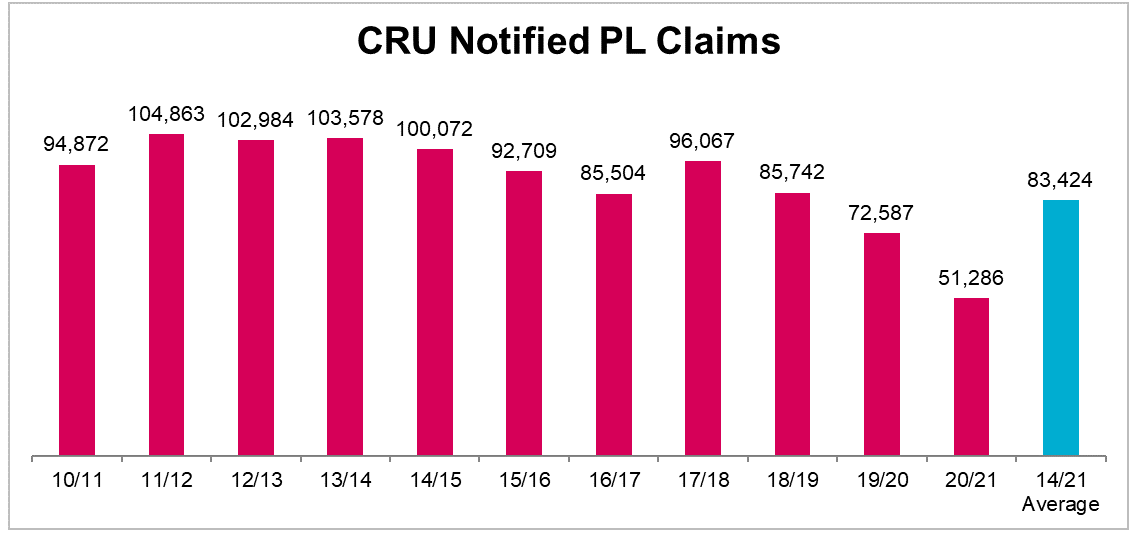

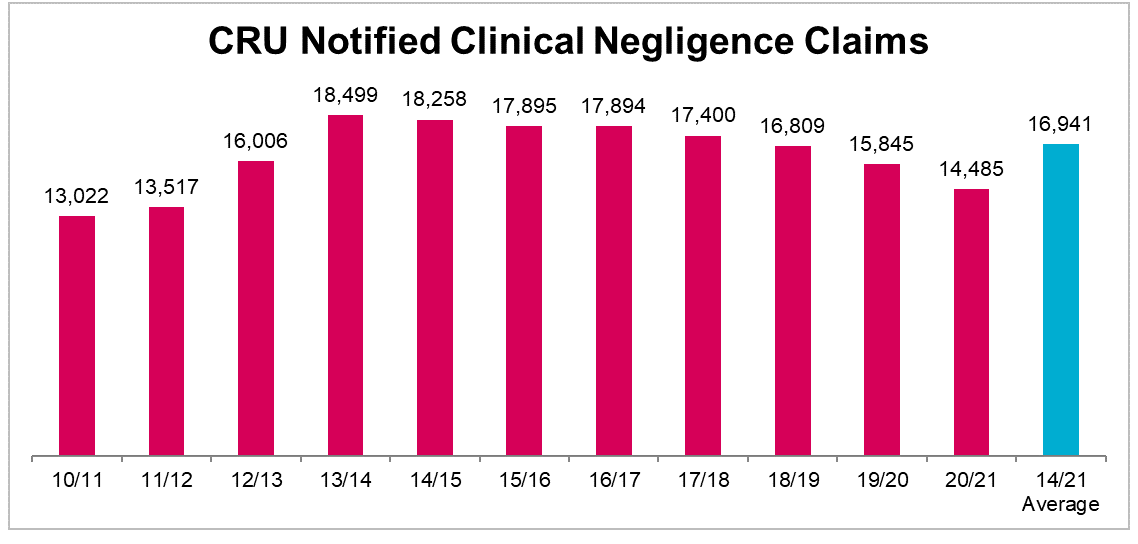

On 2 July, the CRU released their annual data on personal injury claims from 1 April 2020 to 31 March 2021, enabling us to see the effect of lockdowns on all areas of injury claims. The annual number of claims has dropped to 564,359 from 829,252 the previous year, meaning that the number of injury claims has halved since 2012.

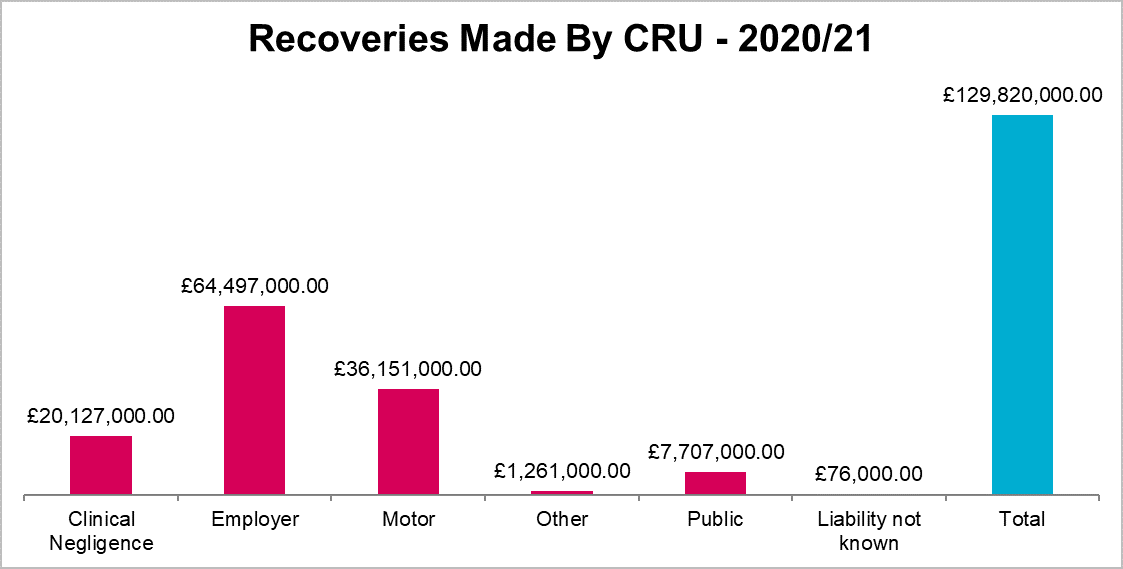

Interestingly we can also see the amount of money recovered by the CRU in 2020/21 – a not insubstantial sum:

Portal Statistics

We now have the portal data for June 2021 but as indicated at the outset we don't have the corresponding OIC data, so need to treat with caution the RTA figures.

RTA

Unsurprisingly CNFs in the RTA Portal fell to their lowest level since records began to 22,650, dropping nearly 30% year-on-year, due no doubt to the commencement of the new Official Injury Claims portal. Month on month, around 15,000 claims have disappeared:

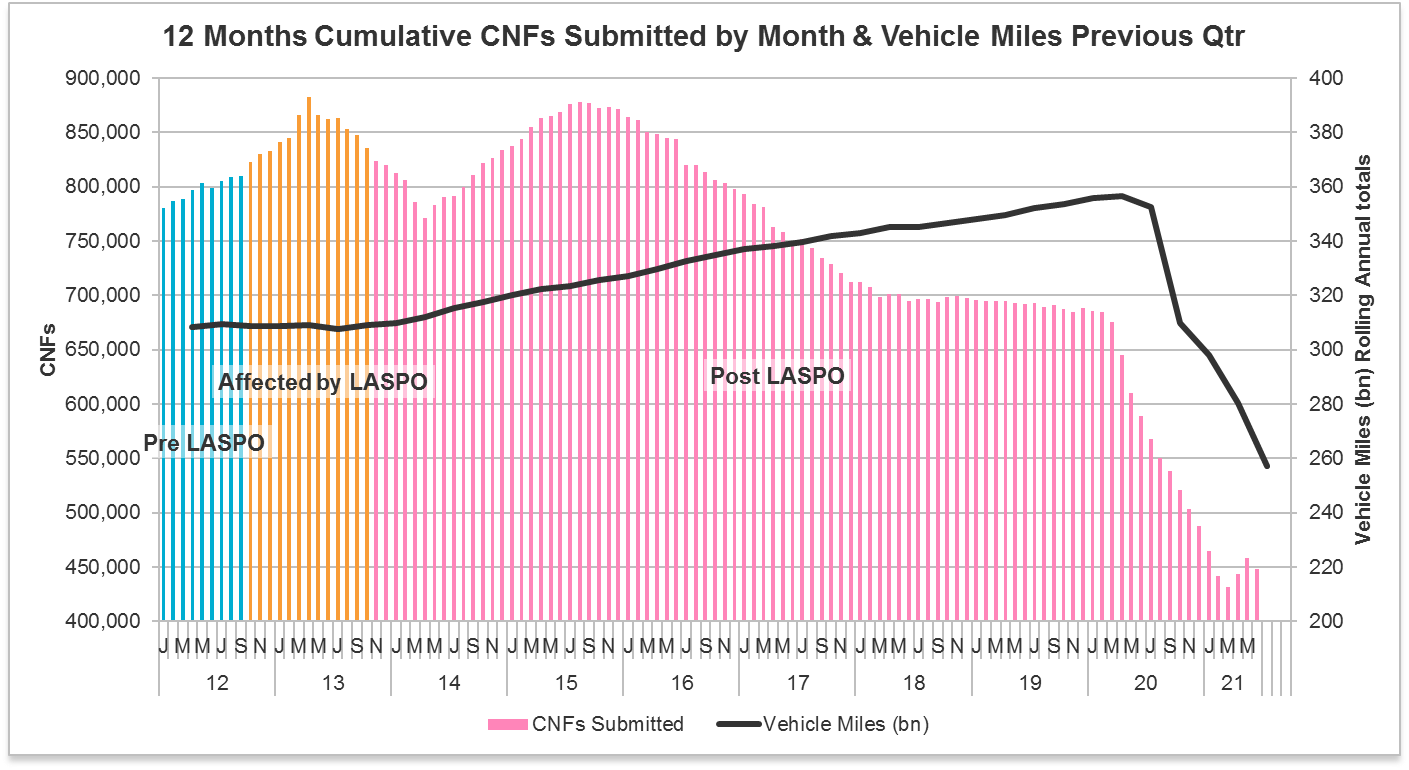

The cumulative figure has also reduced as a result:

EL

In contrast, EL new CNFs in June were up to 2,288, a rise of 27.3% on the prior month and 12.8% on the same period last year.

PL

PL also saw a rise in CNFs to 3,066, a huge 45.8% up on the prior month with a more modest rise of 9.5% on the same point in 2020.

In an area where volumes are relatively low it is difficult to pick out trends from one month, but rising activity levels may be having an effect on claims volumes, plus there is less incentive for established firms to move out of this area of law than RTA.

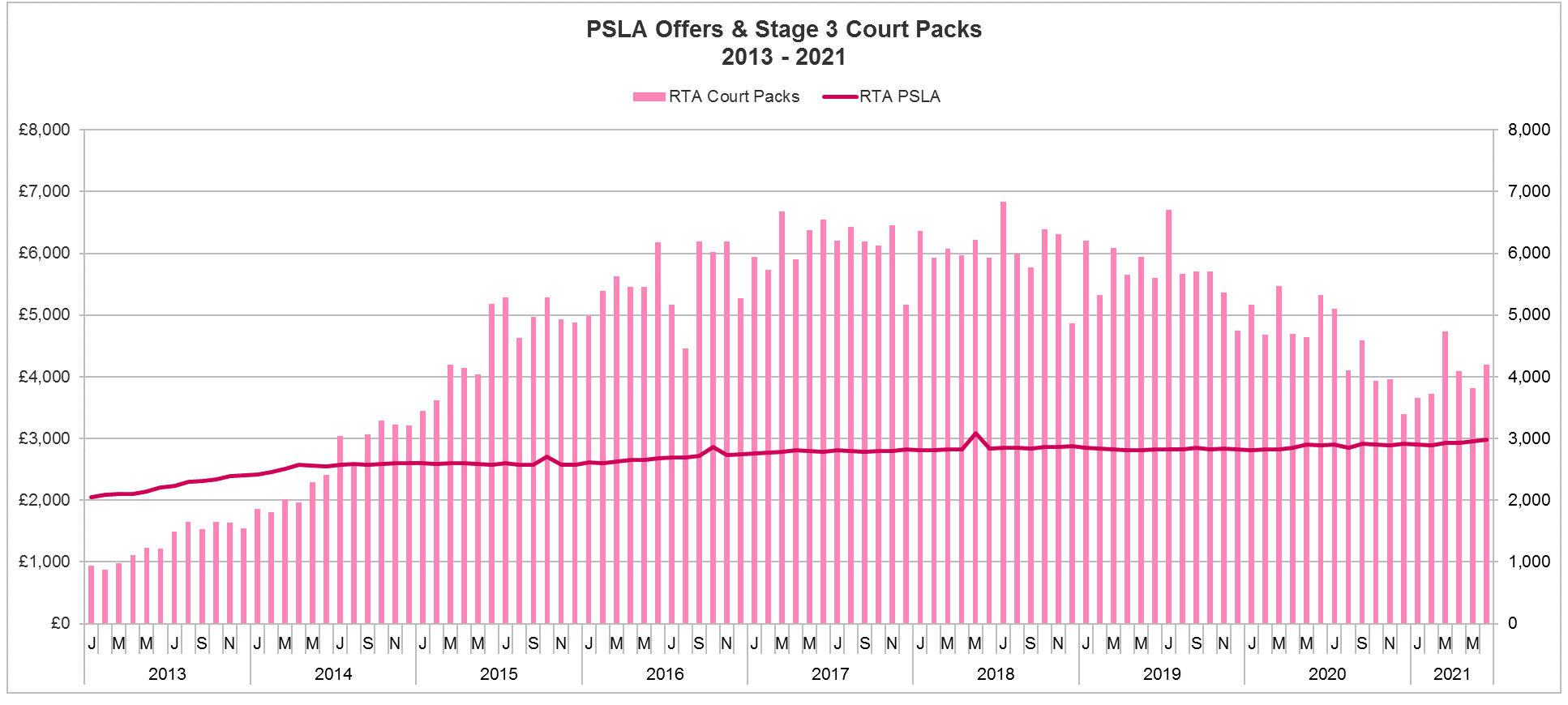

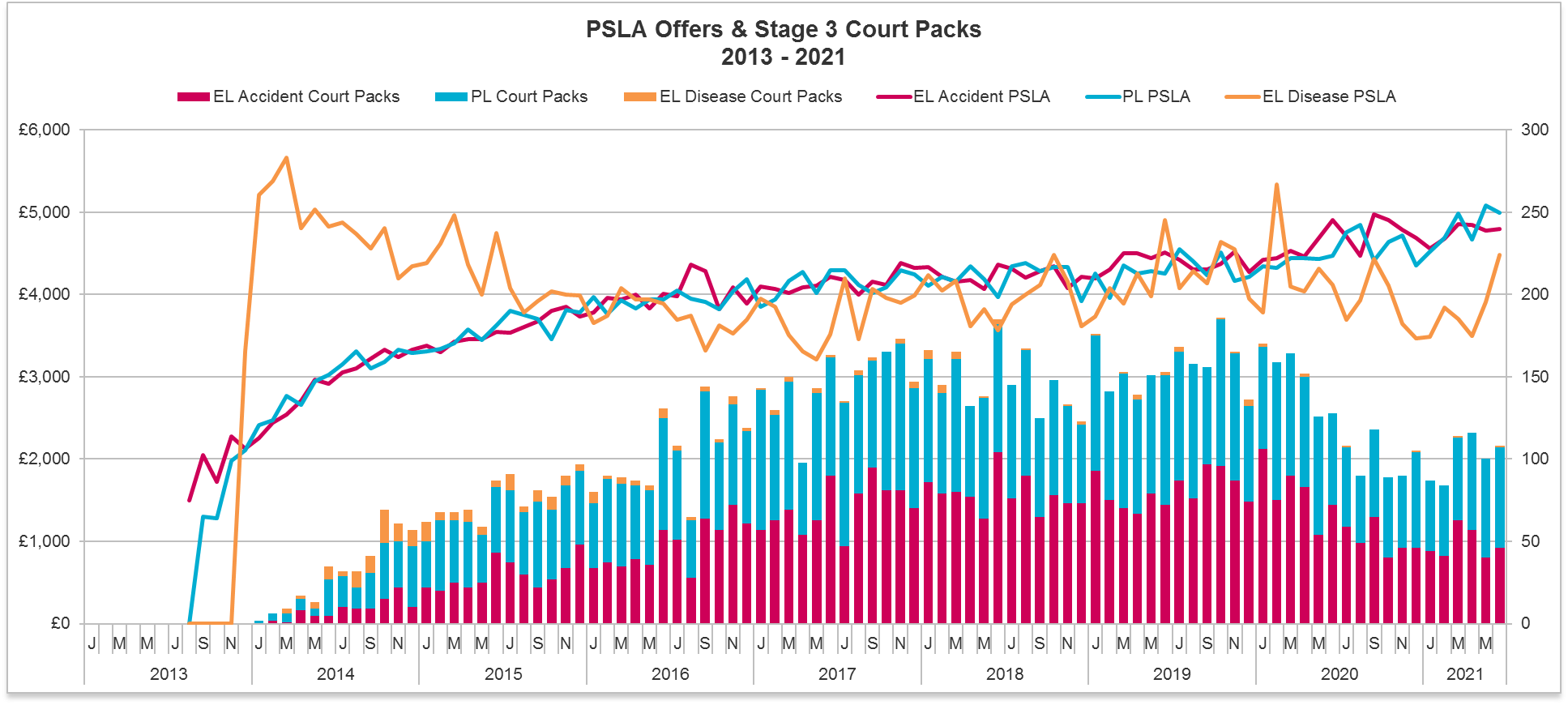

PSLA & Court Packs

PSLA in RTA rose by 0.9% to £2,980 demonstrating a sustained rise albeit at only just over the rate of inflation. The June 2019 average was £2,830.

Court Packs rose in RTA to 4,198, a rise of nearly 10% from the prior month.

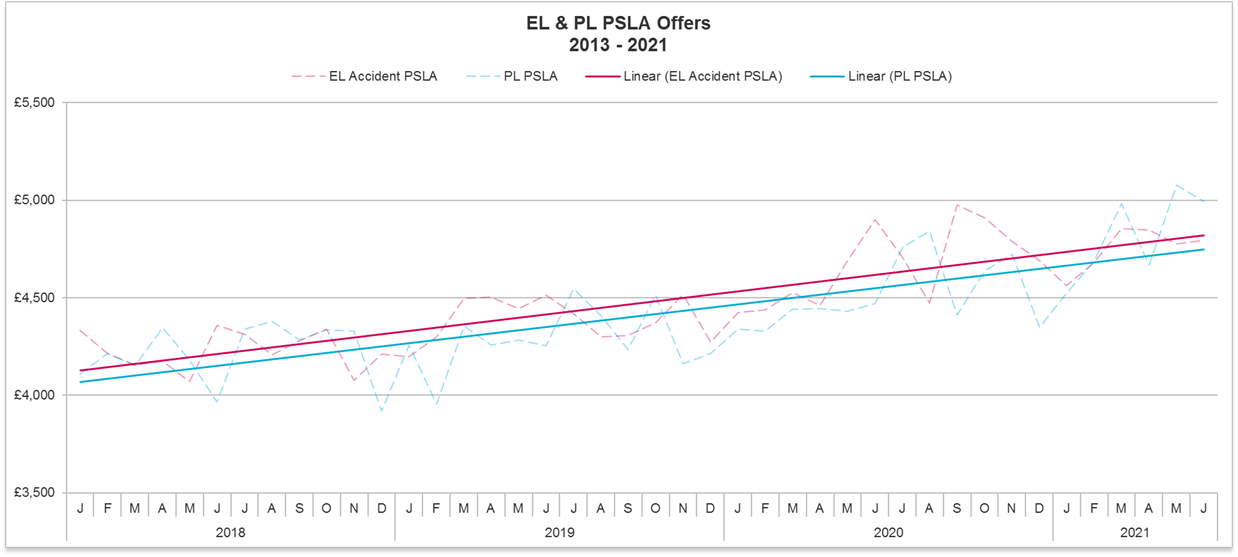

In EL, PSLA rose by a fraction, 0.4%, to £4,795. At the same point in 2019, that figure was £4,511 so again we are not talking much over inflationary rises.

PSLA in PL actually fell slightly to £4,991, but when benchmarked against 2019 this was considerably lower at £4,253 so the rise is above inflation, albeit again on small numbers.

On the chart below, we have overlaid our own trend line showing the rising PSLA settlements in EL and PL claims over the last three years:

EL Court packs were up 15%, a rise of 6 to 46. PL Court packs rose slightly to 61. As can be seen, we are looking at very small numbers here reflecting proportionately much less of a desire in EL and PL claims to proceed to stage 3 than we see in RTA claims:

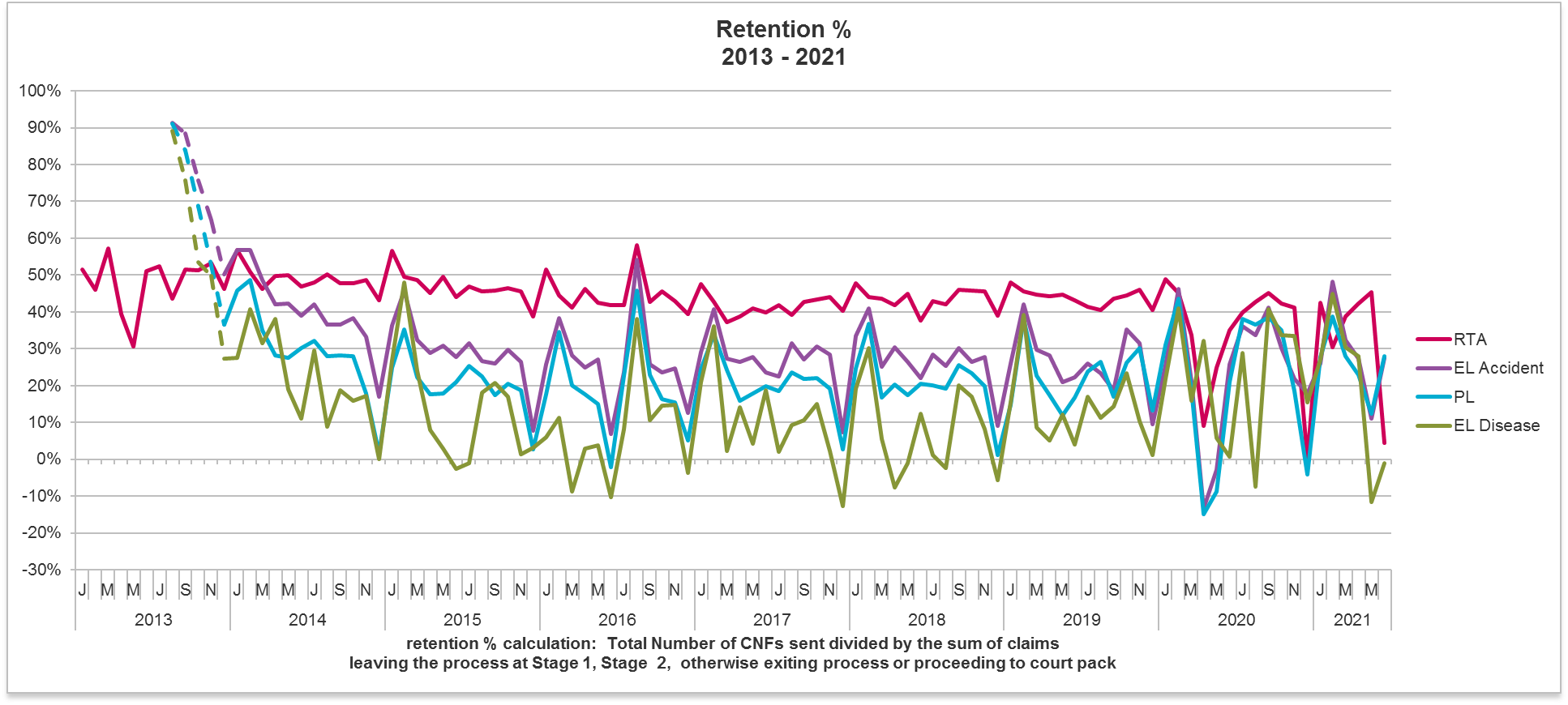

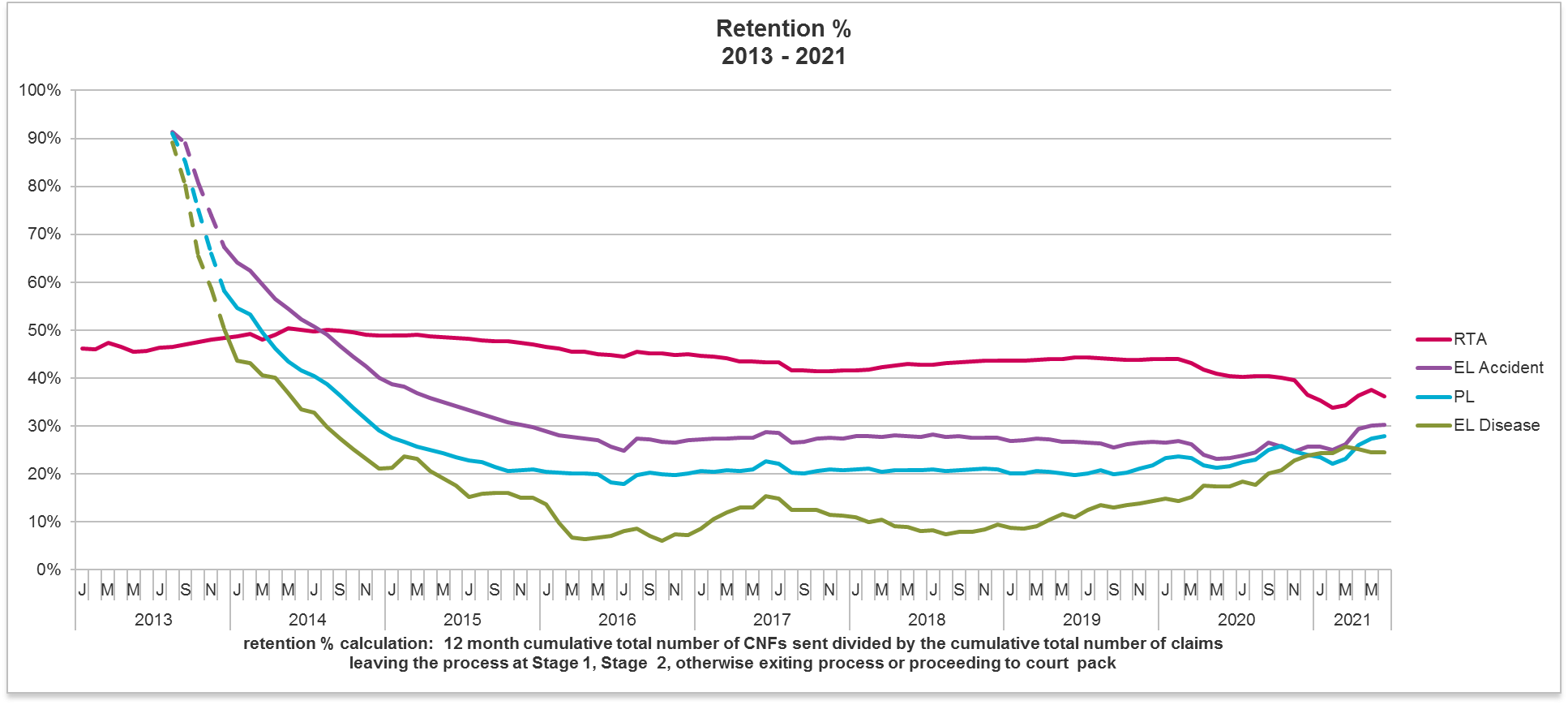

Retention rates

Due to the method of calculation (based initially on the total number of CNFs), unsurprisingly the retention rate for RTA appears to have taken a nose dive, which just shows that statistics aren’t always the best barometer for monthly figures. The cumulative graph gives a better long term picture but still probably doesn’t align with how most Insurers calculate retention rates:

I hope that the round-up has been useful. Covid has had such a significant effect on claims for a long period now, and in the RTA environment we will now have a short period where it will be difficult to see through statistics the effect of lockdown lifting due to the overlay of the new claims process. Only time will tell whether the reduction in claims will be reversed and if so to what extent…