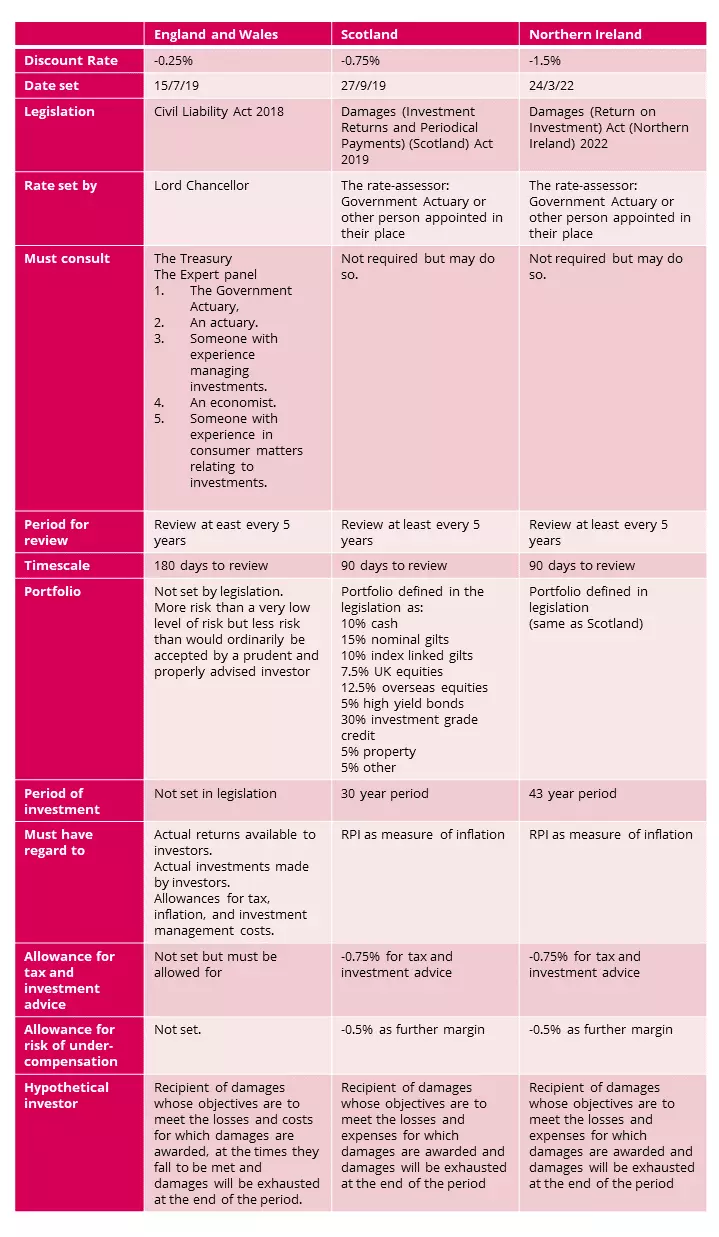

In Scotland and Northern Ireland, the investment portfolio is defined in the legislation and not subject to reconsideration. That is not the case in England and Wales. The portfolio must reflect the nature of the hypothetical investor specified in the legislation which is someone who will accept “More risk than a very low level of risk but less risk than would ordinarily be accepted by a prudent and properly advised investor.” As long as the portfolio reflects that level of risk it can consist of any investments and in such proportion as GAD or the experts consider appropriate.

In their 2019 report GAD considered three low risk portfolios with different fund allocations: cautious, central, and less cautious. GAD recommended that the Lord Chancellor adopt the returns on the central portfolio which had 57.5% allocation to lower risk assets of cash, gilts, and corporate bonds and 42.5% allocation to growth assets of equities and other investments. The portfolio set in the Scottish and Northern Ireland legislation has a lower risk portfolio with 70% in lower risk assets and 30% in growth assets. As a result, it produces a lower return hence the difference in the rates in the different jurisdictions.

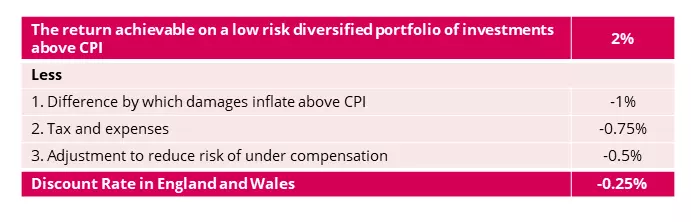

The Institute and Faculty of Actuaries carried out some portfolio modelling of its own in late 2021 and concluded that GAD’s portfolio was not optimal in terms of getting the best return for the level of investor considered. Adopting an “efficient frontier and risk neutral portfolio” produced a return 0.5% higher than the 2% above CPI that GAD found the return to be.

Importantly GAD and the experts are obliged by the legislation to consider the actual investments made by personal injury investors, not just the hypothetical portfolios constructed by GAD. The challenge will be to get evidence of those real investments that are held by claimants and those advising them.

Verdict: modest possibility of change, higher if details of real investments provided

Global

Australia

Australia

France

France

Germany

Germany

Ireland

Ireland

Italy

Italy

Poland

Poland

Qatar

Qatar

Spain

Spain

UAE

UAE

UK

UK