Background

On 16 October 2024, the Department for Transport and HM Treasury launched the Motor Insurance Taskforce, aiming to address the rising cost of car insurance premiums in the UK—an issue that had begun to outpace trends across Europe. The initiative’s core ambition was clear: reduce claims costs to help ease pressure on premiums. Following an initial media announcement and a first meeting, the taskforce appeared to fall silent, prompting industry publication POST to quip in February 2025 that the group was “still alive” but “needs CPR.” Yet, for those within the insurance sector, the story was far from over.

The taskforce brought together a broad coalition of stakeholders, including the Association of British Insurers (ABI), Financial Conduct Authority (FCA), Competition and Markets Authority (CMA), and the Motor Insurers’ Bureau (MIB). While no public statement followed their most recent July meeting, it was soon followed by the release of a comprehensive 33-page report from the FCA examining the drivers behind claims costs in the motor industry. The report would suggest that the FCA has taken a leading role in analysing market dynamics and this will influence the taskforce's final report. Although the taskforce was originally scheduled to run until spring 2026, indications now point to the final report being published as early as September or October 2025, after which the group may disband.

There are bound to be further contributions from other stakeholders, such as the CMA and MIB but the FCA’s analysis could form the backbone of the final recommendations. Other voices, such as the Society of Motor Manufacturers and Traders, are expected to contribute, particularly on repair cost concerns, helping to round out the report with sector-wide insights and practical solutions.

Our regulatory partner, Jonathan Drake added: " The report from the FCA and the work of the Taskforce are important parts of a wider initiative from the UK government for the financial services sector and embodied in the so-called " Leeds Reforms" to drive growth and competitiveness in the sector whilst also ensuring the appropriate level of consumer protection".

For now, the FCA’s report offers a valuable preview of what insurers might expect. It’s a document worth close examination, not only for its findings but for the implications it may carry. As the industry awaits the taskforce’s conclusions, the key question becomes: how can insurers best prepare in light of any forthcoming recommendations or interventions?

Overview

The report stands out as a comprehensive and balanced analysis of the factors driving rising claim costs since 2019 (a year specifically chosen as a reference point as it was unaffected by Covid). It is an assessment that industry professionals will readily recognise. 12 Insurers have contributed said to represent at least 50% of the market and while the FCA remains silent on the contributing insurers, the document succeeds in pinpointing the core issues. It also explores how claims inflation has impacted insurer profitability and, in turn, motor premiums.

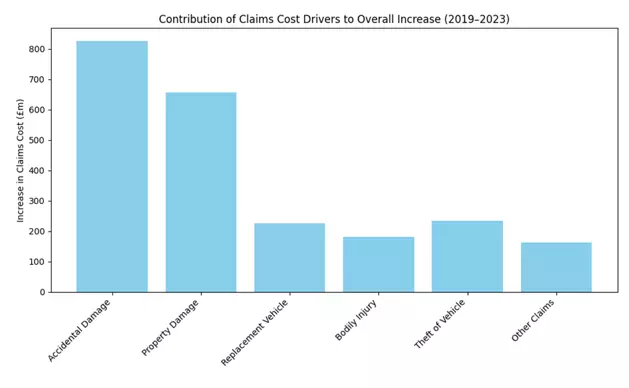

Contribution to claims inflation

The following table illustrates the contribution of each claim category to overall claims inflation.

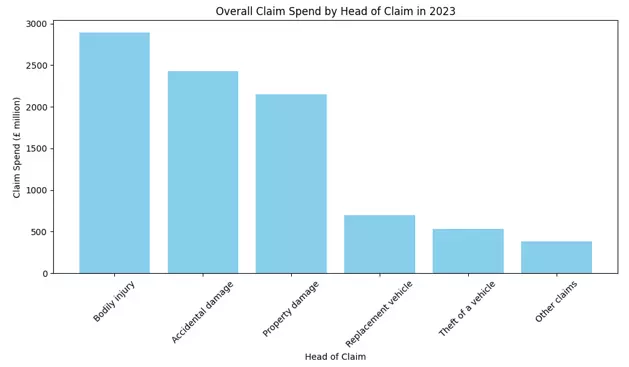

Contribution to overall claims spend

The table below shows overall claims spend by head of claim in 2023:

The report states that premiums have increased 'largely due to increased claims costs', and that the main reason insurers have had to raise prices is largely beyond their control.

The FCA compare claims costs in 2019 with 2023, with the following of note:

- Overall claims costs increased from £6.8 billion to £9.1 billion up 34%, with inflation over the same period 21%, so significantly outstripping inflation.

- Whilst bodily injury (BI) only increased 7%, it was still the largest single item of claims cost in 2023 at £2.89 billion;

- Accident damage (AD) increased a huge 52% rising to £2.42 billion and it could well outstrip BI soon;

- Property Damage increased 44% to £2.15 billion;

- Credit Hire rose 48% to £669 million;

- Theft and 'Other' rose over 70% although cost overall was a much smaller proportion

Whilst overall claims frequency fell by 7% from 2019 to 2023 due to the effect of multiple lockdowns changing driving behaviours, and improvements in vehicle and road safety, the average claims cost rose by 37%

Covid also had a deflationary effect in 2020 which meant that looking at the period from 2021 to 2023 in isolation, the cost of AD and PD rose by 51% and 52% respectively.

AD, PD and replacement vehicle claims costs

The headline figures are a £1.5bn rise in AD and PD claims costs from 2019-2023 which makes up 65% of the total increase in claims costs. Replacement vehicles contributed £226m.

Of note is the significant increase in the average insured vehicle value which rose 42% to £13,223, double the baseline CPI. Improved technology in cars including a growth in EV sales also contributed, leading to more expensive repairs and write off values.

The FCA’s research found that repair times were dramatically increasing – by 36% - with a longer lead in time before repairs commenced. A shortage of mechanics and delays on parts has led to a perfect storm. In addition, time from first notification of loss to final settlement rose across all heads of claim, including for replacement vehicles with the time to settle up by 34%. Lead times for repairs rose 110%, from 15 days to 31.

It may be that we have not seen the worst of it yet: petrol and diesel cars still make up around 90% of insured private vehicles. While EV numbers are on the rise and more expensive to repair, one would hope this should re-set as mechanics train up and get used to the technology, albeit that lithium batteries bring their own issues. But there is a lot of work to do here - the Institute of the Motor Industry stated in 2024 that only 24% of mechanics were EV trained and predicted a shortfall of 3,000 technicians by 2031.

The FCA noted the disparity in repair cost depending on the insurer model. Perhaps unsurprisingly, repair costs were higher where the claimant chose the repairing garage and for claims managed by credit repair firms versus in-house or outsourced repairs controlled by the insurer.

Involvement of CMCs and AMCs

Whilst some insurers acknowledged the benefits CMCs can sometimes bring, and specifically the revenue streams from referrals, the majority view supported by data was that CMCs and AMCs introduce greater complexity and cost. Prolonged lifecycles, higher fees, increased litigation and higher fraud risks were all recognised.

Referral fees were said to range from £30 to over £1000 which ultimately increases claims costs driving premiums higher.

The FCA also noted the increase in google spoofing and that some customers end up with unexpected liabilities when AMCs seek to recover inflated costs from claimants after they are rejected by the insurers. Clearly customer harm is on the FCA’s mind as well as rising premium costs.

AD and PD recommendations

Recommendations in this area were:

- That the Taskforce consider actions to boost the supply of skilled labour, and the how the motor manufacturing industry can reduce lead times and supply chain pressures

- That the ABI and insurers consider further actions to reduce the cost of repair, including in house repair services

- That the ABI and insurers work to develop a good practice code to reduce referrals including mitigating incentives for claimants to use AMCs/CMCs

- That the FCA will work with the ABI and Insurers to better manage claims including having robust procedures to challenge unreasonable 3rd party claims costs

Credit hire

Again, concern was noted around credit repair and credit hire models - issues we will all recognise such as inflated costs, extended hire durations and disputes over repair quality and pricing transparency.

The FCA highlighted that many insurers introduce some claimants to credit hire companies for the provision of credit hire vehicles, even where they have courtesy car cover.

Whilst the number of referrals fell during the period, the average referral fees went up by 29% to £565 in 2023.

Data showed that credit hire claims dipped significantly in 2020 however since then General Terms of Agreement (GTA) claims numbers returned to pre-pandemic levels whilst non-GTA cases were quite significantly lower, so that GTA firms now have a greater market share.

Whilst the overall cost increased very significantly for both – 47% for GTA and 62% for non-GTA, increased duration was clearly a significant driver, up 32% for GTA and 35% for non-GTA, as well as increased daily rate – 12% and 19% respectively This all links in with earlier comments about repair durations increasing, increased write offs and supply chain issues.

Bilateral agreements between insurers and with specific credit hire firms were said to better manage costs.

Disputed non-GTA claims saw average costs rise very significantly – from £2994 in 2019 to £6367 in 2023. One insurer noted 28% of non-GTA claims eventually settled for less than half the issued amount.

Finally, the FCA referenced the disparity between courtesy car rates and credit hire rates – one firm reported average courtesy car cost of £740 v GTA cost of £1901 and non GTA cost of £2537.

Credit hire recommendations

- That the taskforce should consider engaging with stakeholders to assess what further actions or interventions (our emphasis) may be necessary to improve the market;

- That the ABI and insurers consider approaches and processes to better manage and control replacement vehicle costs.

This seems to be inviting the industry to take action, otherwise the FCA may intervene. At DWF we are already on the frontline of developing a specific Credit Hire Pre-Action Protocol designed to better manage costs and the process, although whether CHO's will agree it is of course another matter…

Bodily injury

As noted above, bodily injury represents the highest proportion of cost, but has not seen the same significant increases since 2023. That is largely because, according to the sample data, frequency was down 46%

However, the average claims costs rose from £9,295 to £16,803, an increase of 81%!

This is said to be mainly driven by large bodily injury claims, with a range of factors responsible:

- Rising care costs and wage inflation have increased long term rehabilitation and medical care, accompanied by staffing shortages increasing reliance on agency care with significantly higher rates;

- Increased complexity and duration of high value injury claims leading to higher legal expenses;

- An increase in e-bike and e-scooter usage resulting in a rise in severe injury claims;

- Advancements in vehicle safety and medical treatment resulting in more claimants requiring substantial long term care;

- Increased reinsurance pricing models, reflecting the above.

At the lower end of the market the FCA has recognised that the whiplash reforms have perversely made claims more complex with the proliferation of multi site injuries.

It is also noted that the small claims track level has not kept pace with inflation, particularly when one considers that the JCG 17th Edition published in April 2024 introduced an average increase of 22% for general damages

Medical reports are also criticised, with the initial lack of information meaning more supplemental assessments, and the increased cost of validating/challenging claims. Delays in police reports, court processes, and medical evaluations all lead to longer lifecycles and increased cost.

BI recommendations

The FCA recommended that the taskforce consider:

- How best to contain long term care costs including improved road safety;

- Engaging with the ABI and insurers to review how to monitor and manage bodily injury claims and further possible interventions such as tariffs for other types of bodily injury or increasing the small claims limit;

- Engaging with the SRA, GMC and other professional bodies to consider increased penalties for those engaging in claim exaggeration and fabrication;

- Greater control of micro mobility

From a lobbying perspective there appears to be a lot to go at here. Tariffs for all soft tissue injuries and an increase in the small claims limit would have a really positive impact on low value claims – both cost and frequency no doubt.

In the high value space, a review of care costs and greater measures to control those for third party claims would go a long way to achieving the overall aim of reducing motor premiums.

When the Intermediate Track comes fully into play, it should also reduce costs in the 25-100K space, but we are already seeing signs of layering and costs displacement in this area which follows the pattern of all areas in which fixed recoverable costs have previously been introduced.

Theft claims

Whilst the increase in the number of theft claims has been gradual when factoring in increased policy numbers - 14% up but only 1 claim for every 454 policies, the average value of a theft claim increased 49% to over £10,000. This in turn has been driven by the increase in vehicle values. Taking all this into account, there was a 70% increase in costs per policy, from £13.52 to £22.95.

Theft recommendations

That the taskforce consider:

- Engaging with the motor industry to better protect vehicles from theft;

- Controlling the online sale of technology used to steal vehicles; How to reduce the volume of stolen vehicles shipped abroad:

- Increased penalties for those involved in vehicle theft.

The recommendations to tackle this area may sound a little on the woolly side, mostly focused around technology. However that works both ways and criminals tend to adopt new technology nearly as quickly as it is introduced. In any event it seems to be something for the motor industry to tackle rather than anything insurers can directly control.

Fraud

Fraud continues to be an issue raising the base costs of insurers due to increased headcounts and technology/legal costs used to fight fraud.

According to ABI data, whilst suspected fraud has declined, confirmed fraud has increased, a value of £49m in 2019 to £65m in 2023, suggesting either improved fraud detection or fraudsters adopting more sophisticated tactics to evade detection.

The report mentions all the reasons we know well, including increased bent metal fraud being more profitable, exaggerated personal injury claims with associated layering costs, Gen AI being used to fake images plus ad spoofing and ghost broking.

Fraud recommendations

The FCA recommended that the taskforce consider:

- Action against social media and technology companies which have not taken sufficient action to tackle fraud on their platforms;

- Potential higher penalties for professionals in particular, who are engaged in motor insurance fraud;

- Bringing stakeholders together to enhance fraud detection.

We would also draw your attention to our virtual conference on the 16th September 2025 on AI Risks in Insurance Fraud. Please contact Lauren France for a Teams invite.

Uninsured driving

Lastly, the MIB provided data from the whole market in relation to the cost of claims and levies.

The cost of claims linked to uninsured drivers rose from £329m in 2019 to £452m in 2023, with the corresponding levy charged to all insurers rising from £331m to £507m. The recommendations in this area include increased checks to identify uninsured vehicles, and harsher penalties and bans. The MIB has itself commenced its own five-year plan to eliminate uninsured driving, with it being suggested penalties could be tripled to act as a deterrent.

Conclusions

The FCA has pinpointed the drivers of claims inflation across each category and proposed recommendations to address them. However, it stops short of offering financial forecasts to gauge the potential impact of these measures.

It may seem logical to prioritise repair costs as key contributors to both accidental and property damage inflation. Yet this view overlooks the degree of influence the industry and its stakeholders wield over each claim category, and the likely effectiveness of proposed interventions.

Another pressing concern is the potential for further deterioration across claim categories. As an example while the report notes a decline in low-value bodily injury claims, it also flags rising severity, driven by layering, exaggeration, and professional enablers.

The decline in low-value bodily injury claims stems from fewer accidents and the successful rollout of whiplash reforms, which curbed spurious claims. However, rising severity threatens to undo these gains. If left unchecked, this could trigger a resurgence in the frequency of low-value claims, eroding the reforms’ impact.

Coupled with escalating costs in high-value claims which are yet to show fully in data due to claim development lifecycles, bodily injury may soon re-emerge as the most dominant cost driver.

The FCA also highlights the market’s complexity, where referral fees from CMCs and AMCs both benefit insurers and inflate costs. These fees fall outside insurers’ Combined Operating Ratios, yet the resulting profits influence underwriting and help shape pricing, especially in personal lines.

This report lays a solid foundation for the industry and its stakeholders to explore strategies that reduce motor claim costs, bolster insurer profitability, and therefore stabilise premiums. These efforts are crucial to shielding consumers from inflationary pressures beyond the industry’s control such as rising vehicle values and the intricacies of EV repairs. We look forward with interest to the next steps of the Government taskforce.

What about home and travel?

As well as reviewing the Motor market, the FCA also carried out a separate review of home and travel insurance handling, in the light of the Consumer Duty regulations which came in during July 2023. Claims handling practices at 15 home insurance providers and eight travel were reviewed, with mixed findings published on the 22 July 2025.

The FCA reviewed the claims handling arrangements of 15 home insurance providers and eight travel insurance providers based on reporting data submitted between 2022 and 2024. It carried out the work in response to intelligence indicating some instances of poor claims handling practices and firm behaviour. Home and travel products were selected as they are the most commonly held products within the insurance market behind motor insurance.

Although the FCA found that some firms are closer to meeting its rules, it found others may not be meeting their obligations under the Handbook and may be failing to consistently deliver good customer outcomes, as required under the consumer duty. The FCA sets out its expectations, good practice and areas for improvement that it saw based on the following areas:

- Insurers oversight of outsourced claims handling providers. Some insurers (all of which substantially outsourced their claims handling operations) had limited control over their outsourced arrangements or material weaknesses in their oversight of their outsourced arrangements. Where there is limited control over outsourced arrangements, this raises concerns about whether these firms are complying with the FCA's outsourcing rules or have arrangements that risk causing harm to their customers.

- Availability and use of management information (MI). The FCA found shortcomings in the claims MI produced and reviewed by some firms across home and travel. The impact of these shortcomings can be far reaching, affecting firms' governance and oversight capabilities and ultimately customer outcomes.

- Claims handling arrangements, including storm claims and the use of cash settlements. The FCA found too many examples of customers not receiving the service that they are entitled to.

- Claims governance. Firms were often less able to show how their governance arrangements were helping them oversee their claims handling arrangements effectively. In many cases, the minutes of key claims committee meetings lacked sufficient detail to prove meaningful discussion, challenge or decision-making.

The FCA will provide individual feedback to all firms in its review and will work with firms, trade bodies and other stakeholders to improve claims handling arrangements and deliver improved outcomes for customers. It said that it will not hesitate to act using its regulatory powers where it is concerned that firms are not upholding the requirements of the consumer duty or its regulatory requirements.