Background

Last February, Sir Terence Etherton MR set up a Civil Justice Council working group tasked with reviewing the guideline hourly rates (GHR). The working group has now published a draft report, which is open for public consultation until 31 March.

The GHR, which have not changed since 2010, were last considered in 2014 by the CJC costs committee. The main headline following that review was that the then MR, Lord Dyson, felt unable to accept any changes to the actual rates because there was a fundamental shortcoming in the available evidence at that time.

Being conscious of both the evidential issues from the last review, and two recent High Court decisions allowing significantly increased hourly rates, we undertook a comprehensive review of our own data, enabling us to make detailed and evidence-based submissions to the working group.

Current review & methodology

The urgency of this review is reflected by the working group’s short timescale in which to produce the report - during Trinity Term 2021 i.e. by the end of July. There has been criticism that the timescale was unrealistic for such a major exercise and that the review was being carried out at a time when significant changes were taking place within legal practices even before Covid-19 impacted. There was also concern that no attempt was made to obtain and analyse data from law firms as to the ‘expense of time’, i.e. what it costs to run a practice before any profit is made.

The working party has rejected these criticisms. As far as the expense of time was concerned, they formed the view that not enough firms are prepared to divulge the necessary information to make such an exercise any more valid than the methodology used for this review.

The methodology adopted was to ask all costs’ judges in England & Wales to complete an electronic form for the rates they allowed on all provisional and detailed assessments carried out between 1 September and 27 November 2019. Other interested parties were invited to provide the same information but, in addition, details of the rates allowed on summary assessments or agreed between parties for a longer period: 1 April 2019 to 27 November 2020.

DWF submissions

DWF sent detailed submissions to the working group in November setting out our concerns which included, the timing of the review, the changing landscape and home working due to Covid-19 and the limited data set being sought.

We were one of the few firms of solicitors to send in a substantive response and the only defendant insurance practice to submit data. Our submissions and data with analysis were taken into account by the working party.

In our summary of the data, we made a number of points, some as the report acknowledges were also made by others but, in addition, we included the following points which appear in the body of the report and appear to have had a positive impact on the recommended rates:- reductions of 30% were made in profit costs claimed suggesting that rates claimed are not reflective of rates paid on settlement;

- hourly rates agreed are typically 18% lower overall than rates claimed and 21% lower for grade A fee earners;

- the rates we agreed on our settled cases broadly mirrored existing GHR to within a margin of less than 1.5%, save for a margin of 2.6% for grade B fee earners;

- hourly rates claimed for London firms were broadly 25% higher than for provincial firms and, on settlement, were reduced by an average of 20% compared with 15% for regional firms. In the light of this, we suggested that this perhaps indicated that London rates do not ‘need to be set so far adrift from the provincial rates’;

- reliance on counsel should lead to a commensurate reduction in time spent/rates claimed;

- where a Costs Management Order (CMO) is in place, hourly rates are reduced on average by 12%, compared to 17% in litigated cases where no CMO is in place.

In summary, we argued that on the evidence we produced, the current GHR are at the right level.

CJC recommendations

Despite all of the criticisms of its methodology, the working group considered that the data sample sizes were sufficient for its purposes and more indicative of the appropriate GHR than would be achieved by applying straight inflationary percentage increases to the existing GHR. A qualification to this is London zones 1 and 2. For these, it was recognised that the available data was very limited. Nevertheless, having suggested that London zones 1 and 2 should be redefined, revised GHR have been recommended but subject to further review at a later date.

As for the rest of England and Wales, the working group concluded that the pooled data received from experienced costs’ judges and professionals was the best evidence on which its recommendations could be made.

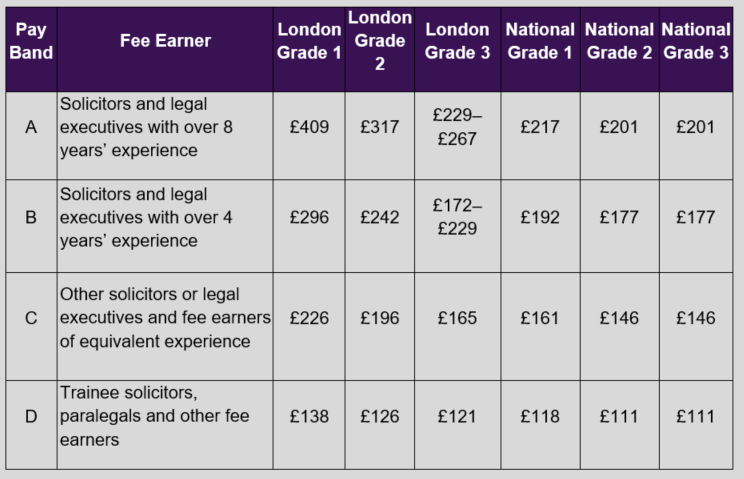

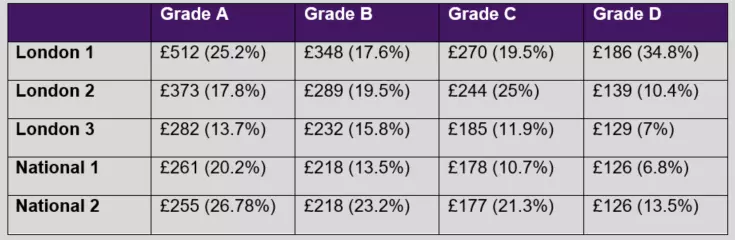

The following tables set out the existing rates and the working group’s recommendations, with the figure in brackets representing the increase.

Current rates

Recommended rates

The working group considered that there is no longer any justification for having three provincial areas or ‘bands’ for costs purposes and it has therefore combined national groups 2 and 3. The proposals for which parts of the country fall into which of these new bands, pending any further review is as follows:

- The counties of Kent, East Sussex, West Sussex and Surrey should become National Band 1 counties. Medway, Maidstone, Canterbury, Lewes and Guildford are the only identified centres in those counties and each is categorised as National Band 1;

- Existing National Band 1 counties and other identified National Band 1 centres will remain in National Band 1.

- All other areas will be/remain in National Band 2.

As would appear clear from the comments in the report, our data made a positive impact on the recommended rates. We had concerns about the direction of travel regarding the rates following the recent decisions in PLK and Cohen where guideline rates were increased by 20% and 35% respectively. The average rate increase proposed is 18%, so lower than we anticipated.

Disappointingly the report did not consider the seismic shift in working patterns caused as a result of the pandemic, which is likely to lead to a significant reduction in real estate overheads, and the increased use of technology, which, as can been seen from the number of law firms downsizing their secretarial and administrative workforce, will lead to reductions in non-fee earning people costs which would otherwise have been a practice overhead.

The report has recommended a three year review, so it is crucial that data continues to be captured on claimed and agreed rates, time and the use of counsel. This is data that we provided for the review and that we will continue to capture and analyse.

The working group has not considered whether the rates will be retrospective or prospective, we believe it should be the latter. It goes without saying that continued robust negotiation is required on third party costs, and hourly rates need ongoing careful monitoring and consideration.

The next stage is to respond to the consultation which closes on 31 March 2021. The consultation questions can be found here.

Please do not hesitate to contact Nicola Critchley or Simon Murray should you wish to discuss your own consultation responses.