We start with a review of the newly published OIC data from the MIB/MOJ.

The first quarter release showed 45,718 new claims submitted over June, July and August 2021. Of these, the vast majority of claimants, 90%, were represented by law firms or other organisations. Over the same period there were 52,389 MOJ cases submitted (see further below for this month's MOJ Portal stats).

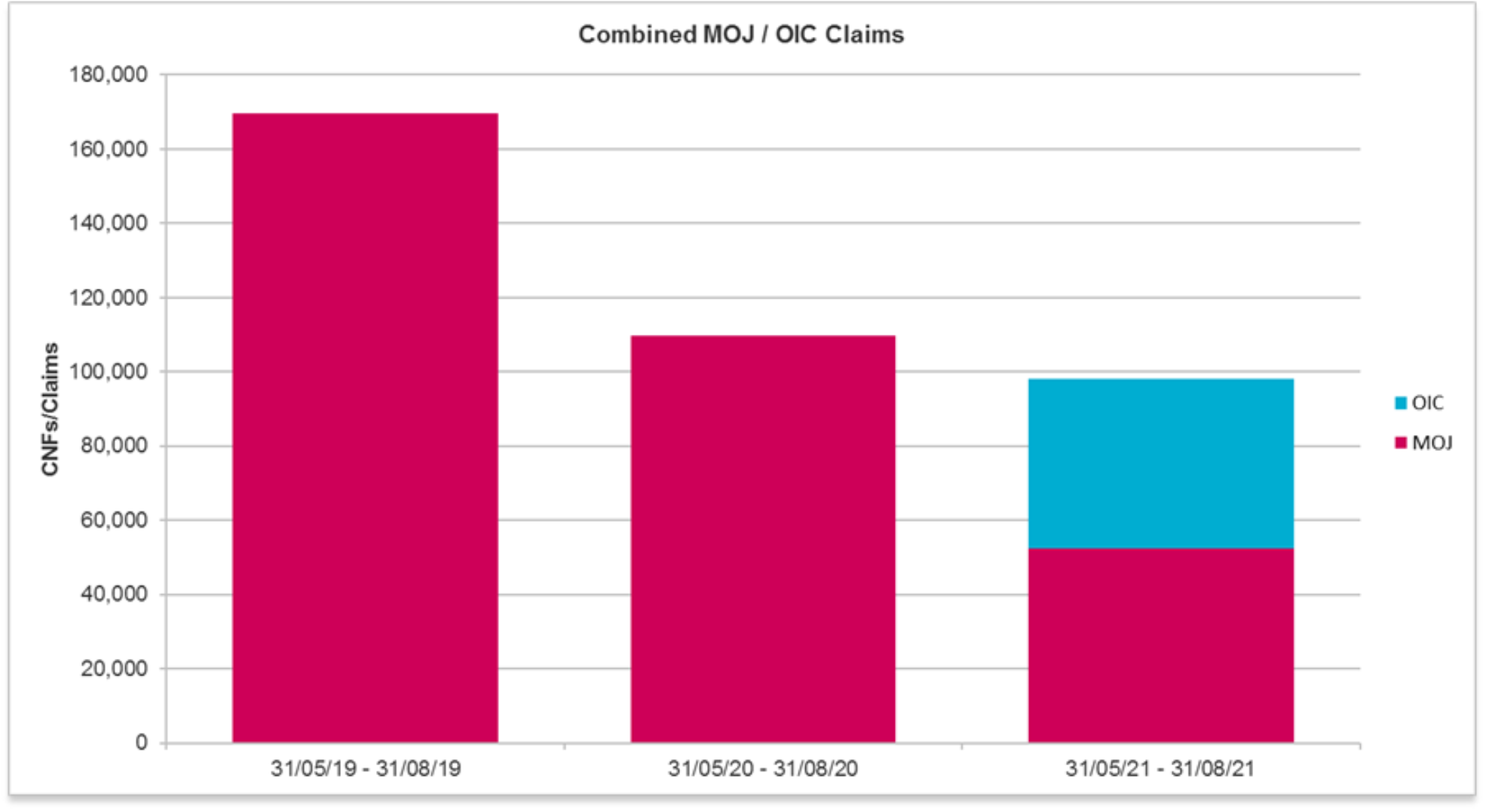

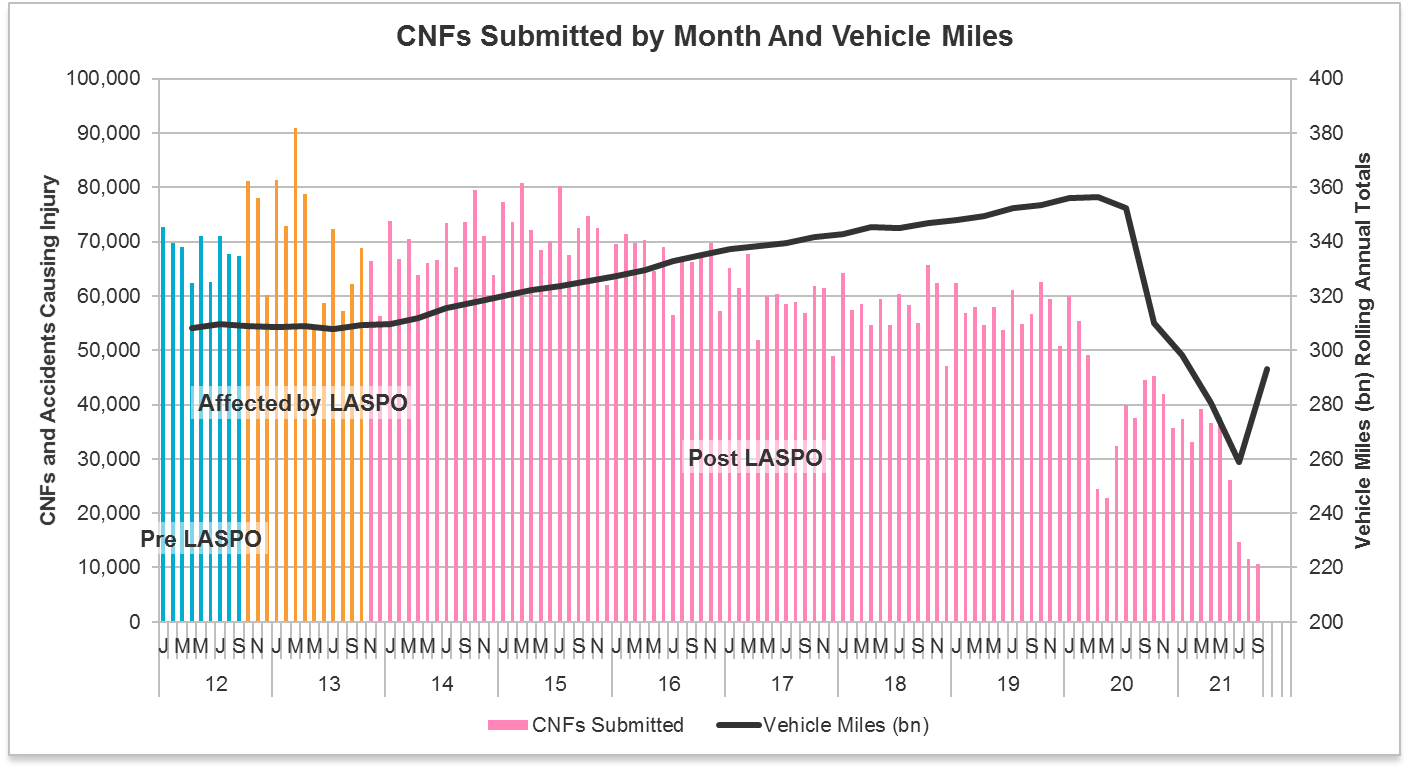

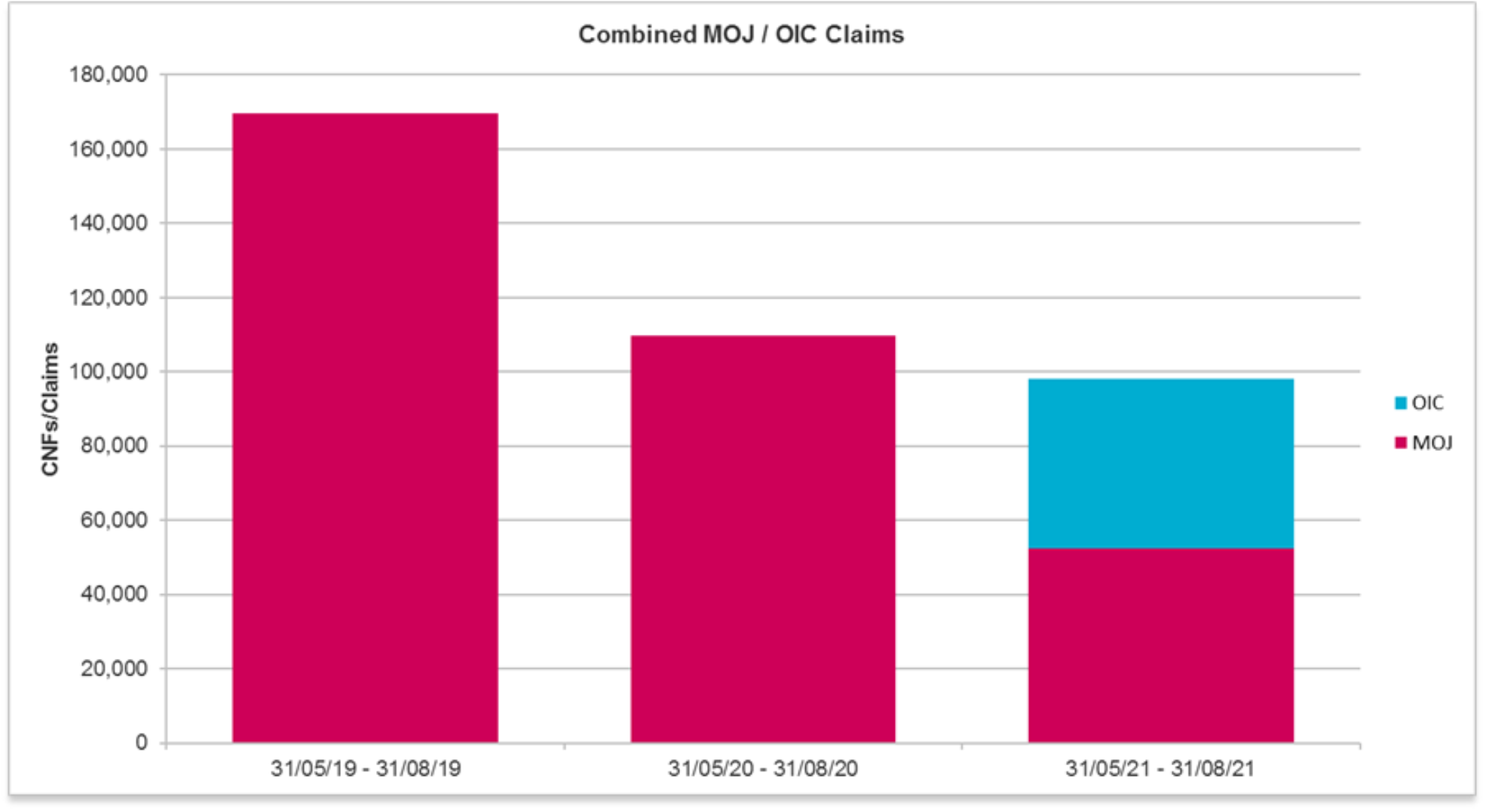

Undoubtedly the combined number of CNFs and SCNFs at 98,107 is lower than "the norm" for the three month period. However in a world so affected by external events it is hard to identify what the baseline figure actually should be.

The preceding three months prior to the new OIC portal (March, April and May) showed a total of 113,901 CNFs and so a reduction of around 14%.

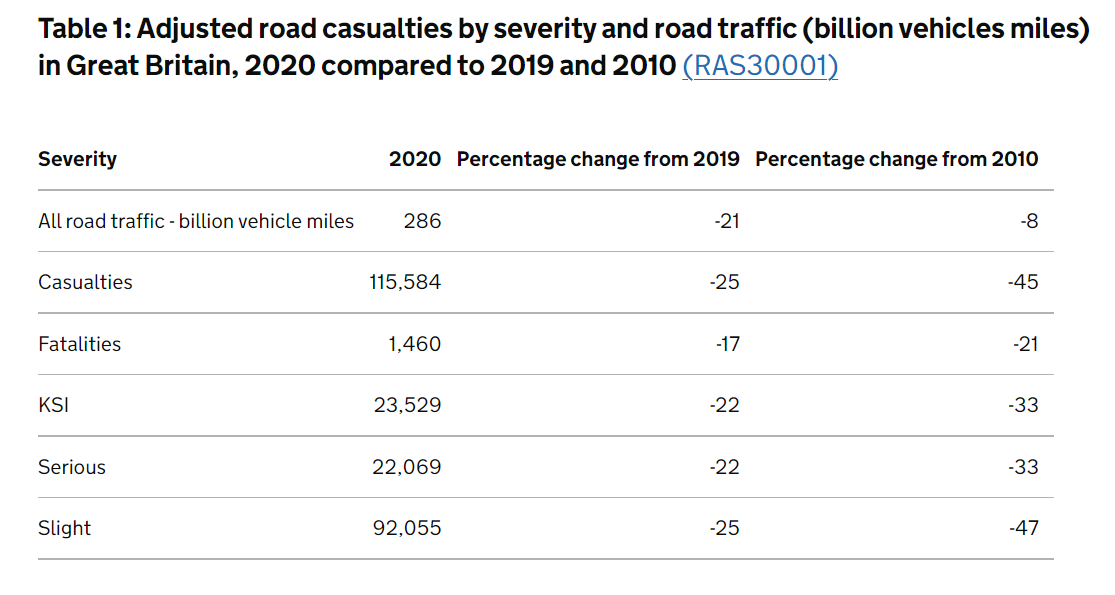

It is perhaps also helpful to compare the position in the MOJ Portal over the 3 month period, June to August, going back to 2019, which was the last year completely unaffected by the reforms or the Covid reduction in accident frequency.

1 June 2021 – 31 August 2021 98,107 combined OIC and MOJ

1 June 2020 – 31 August 2020 109,672 new claims (MOJ)

1 June 2019 – 31 August 2019 172,550 new claims (MOJ)

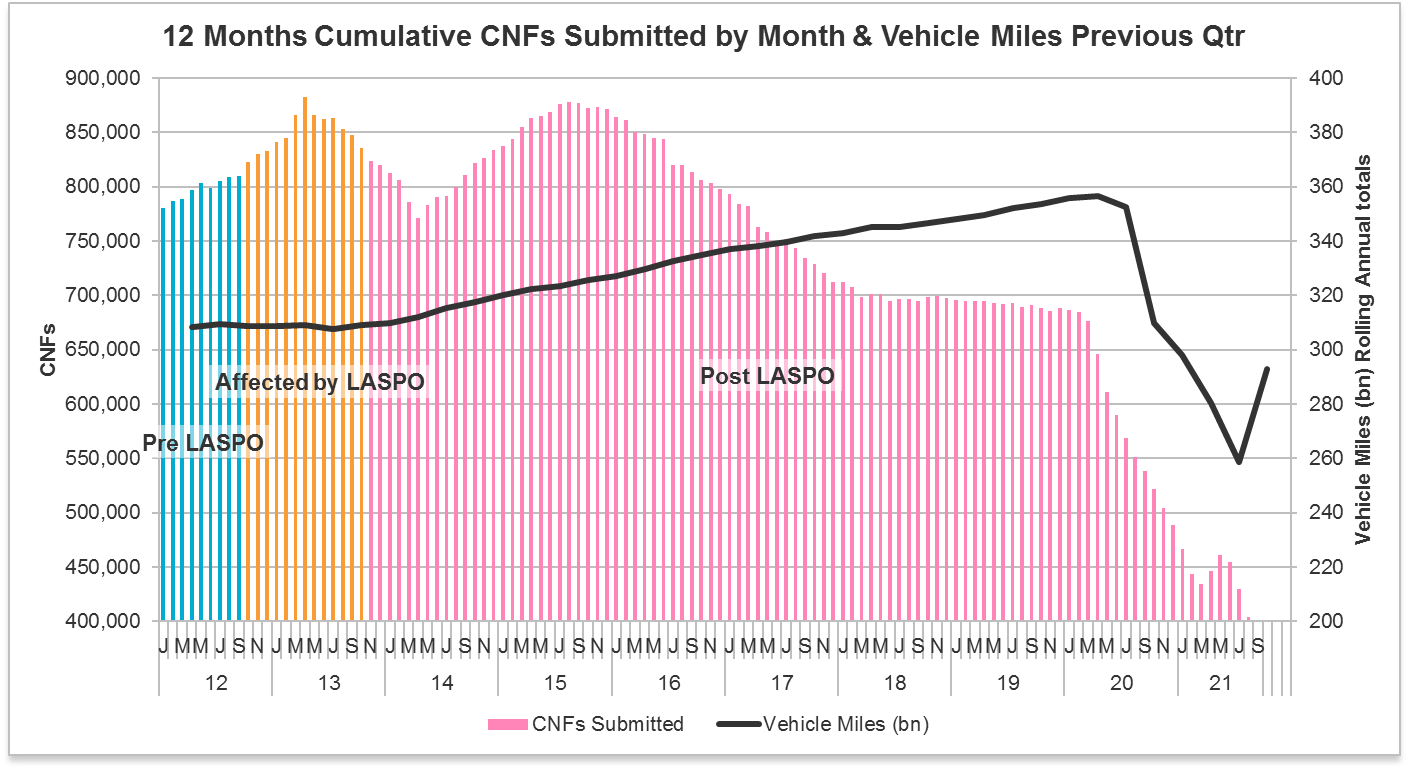

This is demonstrated in the following graph:-

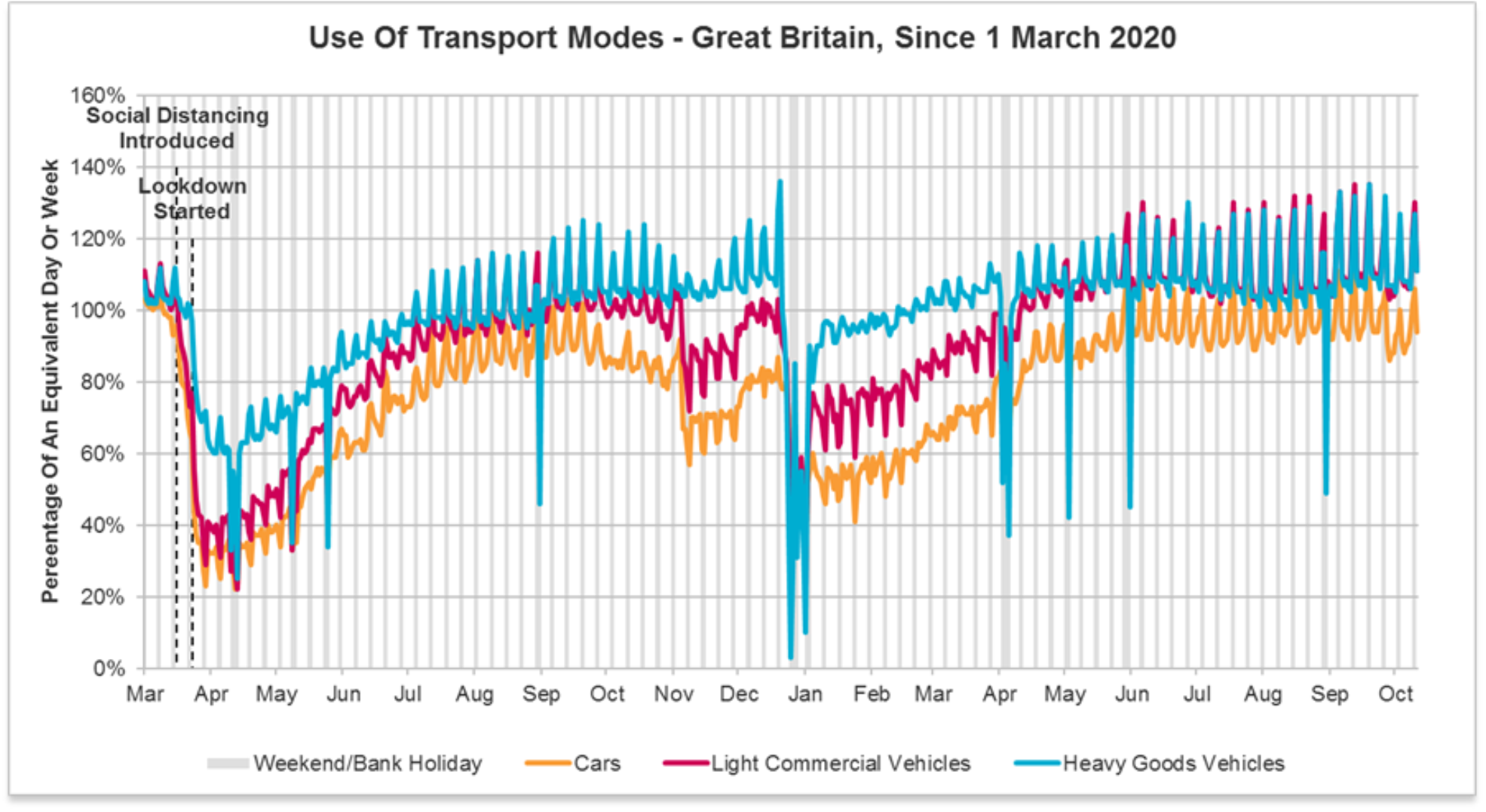

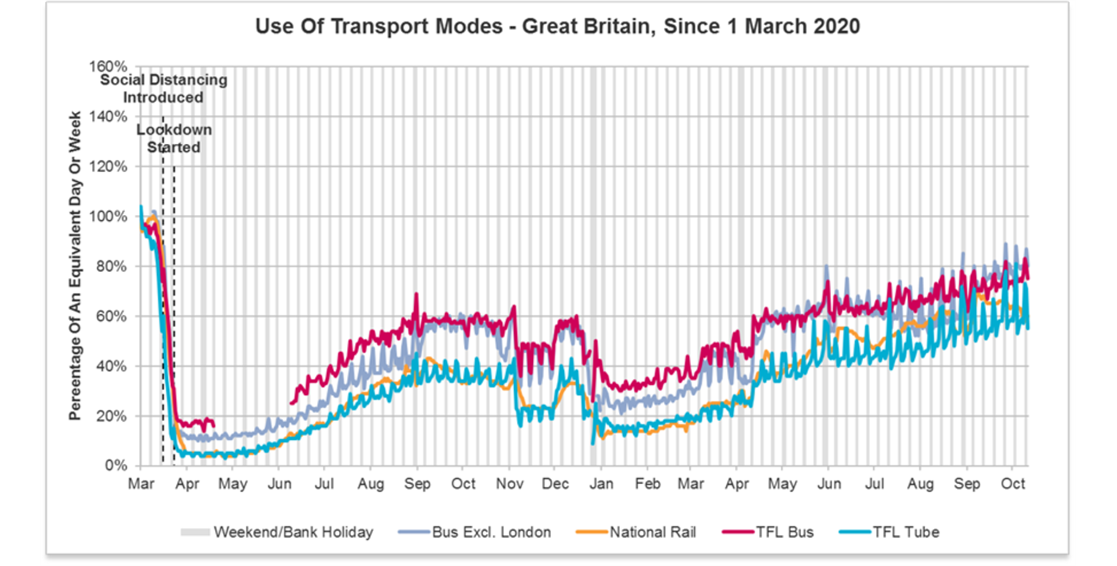

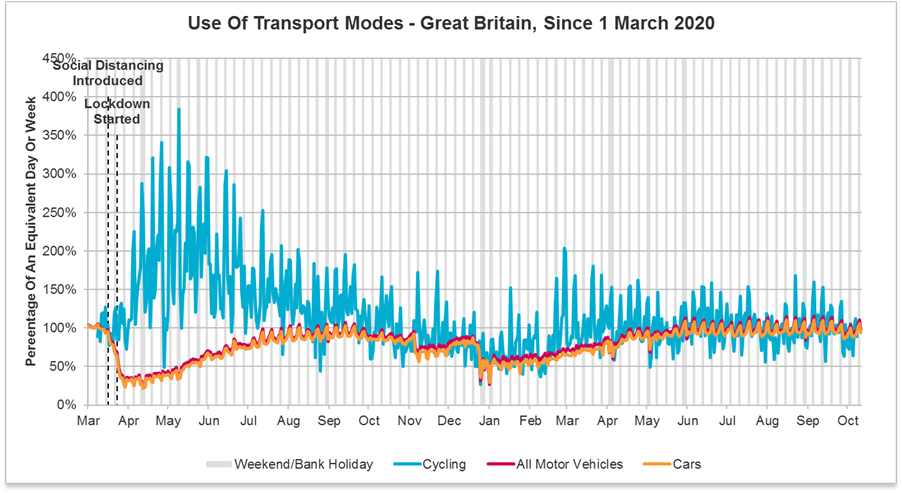

June, July and August 2021 have for the most part been free of Covid restrictions and regular readers will know that road transport usage was pretty close to pre-Covid levels, or even above in the case of HGVs. Covid cannot be entirely blamed for the low number of claims in this first quarter.

Then we also have to factor in that June to August is probably not the correct comparison. June would be skewed by the majority of accidents being pre 31 May and so the true comparison should be from July onwards. That may be a factor in the reason the MOJ have decided to release homogenised figures for the quarter so the drop does not seem as significant as it really is. Only time will tell.

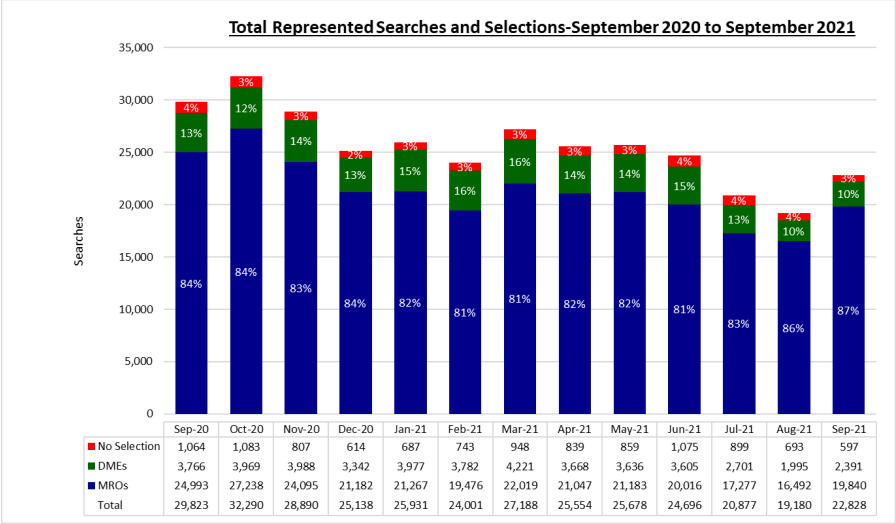

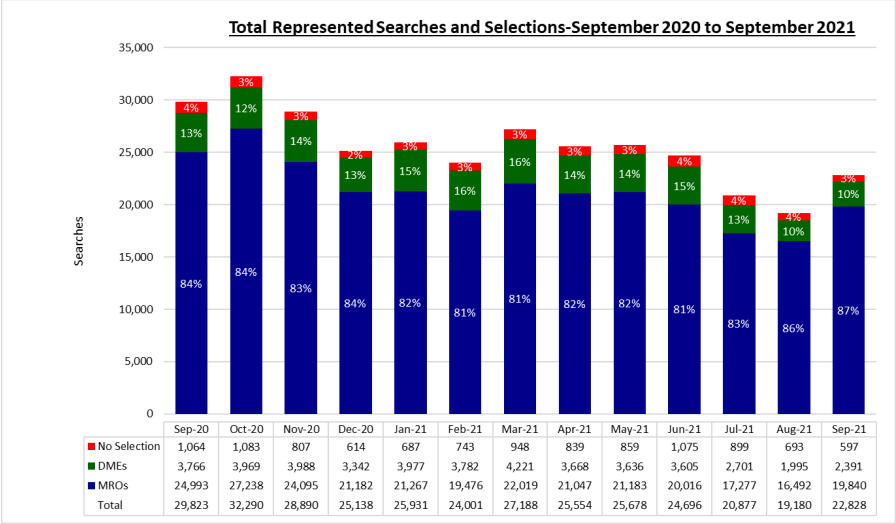

The MedCo data released more quietly at the same time illustrates this point perfectly. June was remarkably similar to May in the number of searches and selections, but June and July had 20% reductions:

The question many compensators are asking is whether the reduction in volumes is a permanent trend or a temporary dip. Is it the result of the general disruption to the claimant market combined with teething issues with the system itself? A glass half full view would consider the reduction in volumes to be a testament to the success of the CLA, with the ban on pre-meds and the lower damages/non cost bearing environment supressing spurious claim volumes. We will know more as we see the next two sets of quarterly data.

Of the 485,000 baseline claims estimated pre-reforms in the Whiplash impact assessment, the MOJ anticipated that around 120,000 of those cases would not proceed – leaving 365,000 per annum post-reforms. Of the 51,000 baseline pre-medical claims, it was anticipated that around 13,000 would not proceed leaving 38,000 to add to the claims involving medicals providing an overall estimated annual claims level of 403,000. Taking the 98,000 first quarter combined OIC and MOJ over the course of a year this actually takes us to fairly near the government predictions, with a forecast of 392,000 claims.

However that impact assessment was of course made without anticipating a Covid reduction…!

In any event if we do see a rise in claims volumes over subsequent quarters then the predicted benefits within the impact assessment may be under threat.

Representation

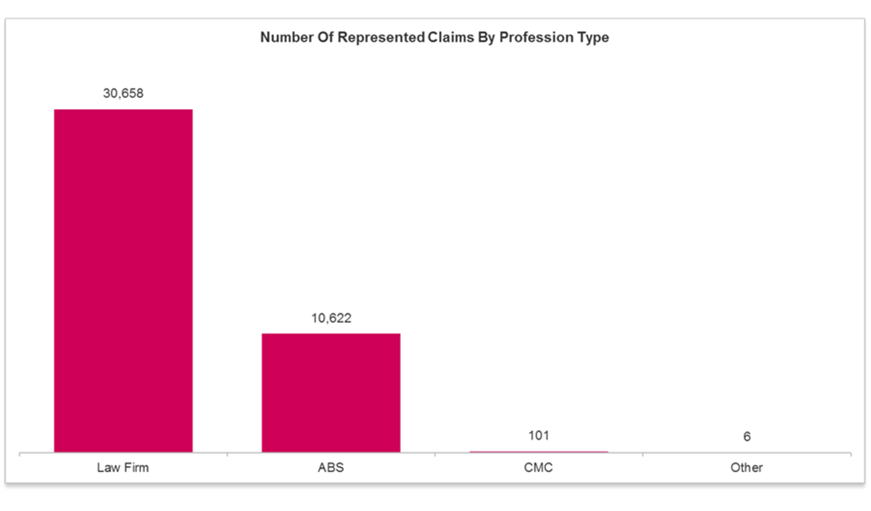

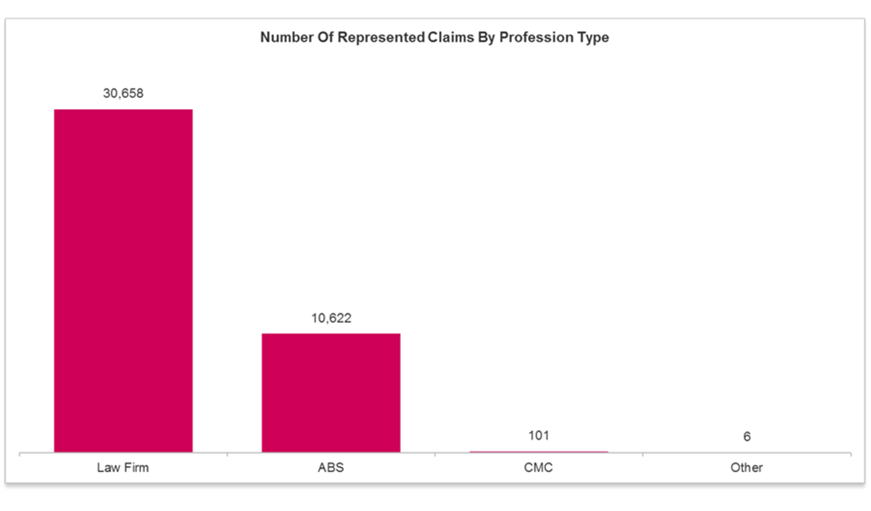

As noted in the headline figures, the vast majority of claimants were represented (41,387) with 4,331 claims or around 10% coming from unrepresented claimants. It is still very early days for the OIC and as awareness of the service grows and the portal process evolves we can expect to see more claims presented without representation.

The graph below shows that where the claimant is represented there is a very low presentation of claims from claims management companies. Given that CMCs are unable to litigate claims within the OIC process we do not consider that we will see a significant growth in these figures in the short to medium term. Compensators have some concerns that not all litigants in person are truly unrepresented but again at this stage it is too early to identify any definite trend here.

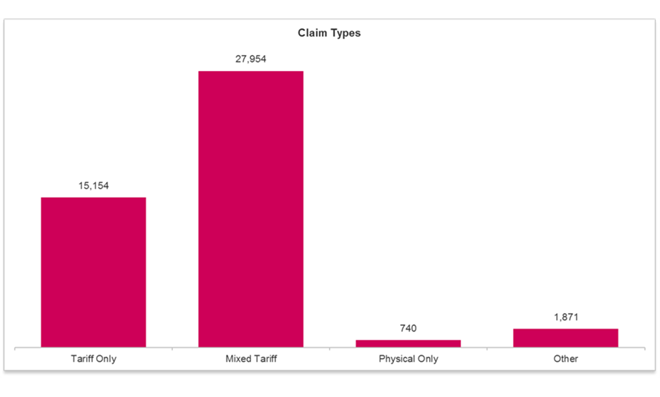

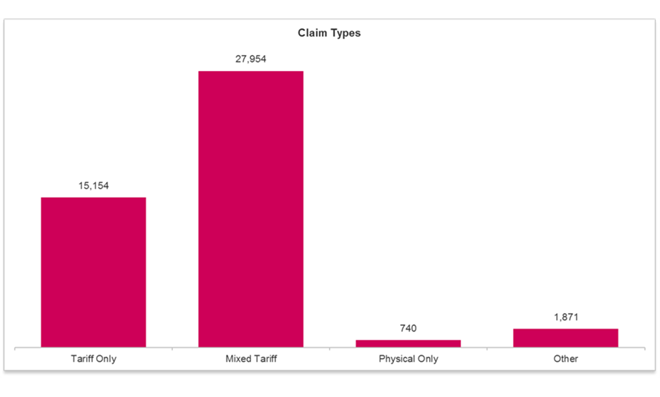

Types of Injury Presented

Before the OIC launched we expected that the majority of cases would include additional injuries on top of the tariff and so it proves. Only 33% of cases were solely tariff, with 61% being mixed claims. 14,776 were defined as 'whiplash + physical + minor psychological', i.e. whiplash plus one additional non-whiplash injury plus minor psychological, which was always expected to be the most popular combination pre-launch.

We should bear in mind that these figures represent the description of the injuries within the SCNF and not the medical report. One trend we are seeing is that represented claimants are using increasingly vague descriptions of their injury within the SCNF. We may well see this trend reflected in the OIC "types of injury presented" data moving forwards.

The real question for compensators is will these high levels of additional injuries carry through to the medical report stage? Medical reports from represented claimants are still trickling through at a much slower rate than for unrepresented. Unless we see a significant increase in medical report volumes in November we may need to wait for the third data release to view a more complete picture.

The slow submission of medical reports means that little progress has been made in respect of the Court of Appeal test cases to decide how the non-tariff aspect will be valued. More news on that is covered below, but without any detail around timescales, reflecting the uncertainty.

Exceptional Circumstances

We can also see the cross industry data supports what we had already mentioned anecdotally – the proportion of claims seeking an uplift for "exceptional circumstances" is way beyond anyone's definition of exceptional. 40% of unrepresented claimants believe their injuries and/or circumstances were exceptional and 24% of represented claimants.

Whilst this is so far based on the data in the SCNF, worryingly we are already seeing a number of medical reports where the experts are also indicating the injuries and/or circumstances were "exceptional", with very little substance to back up the assertions.

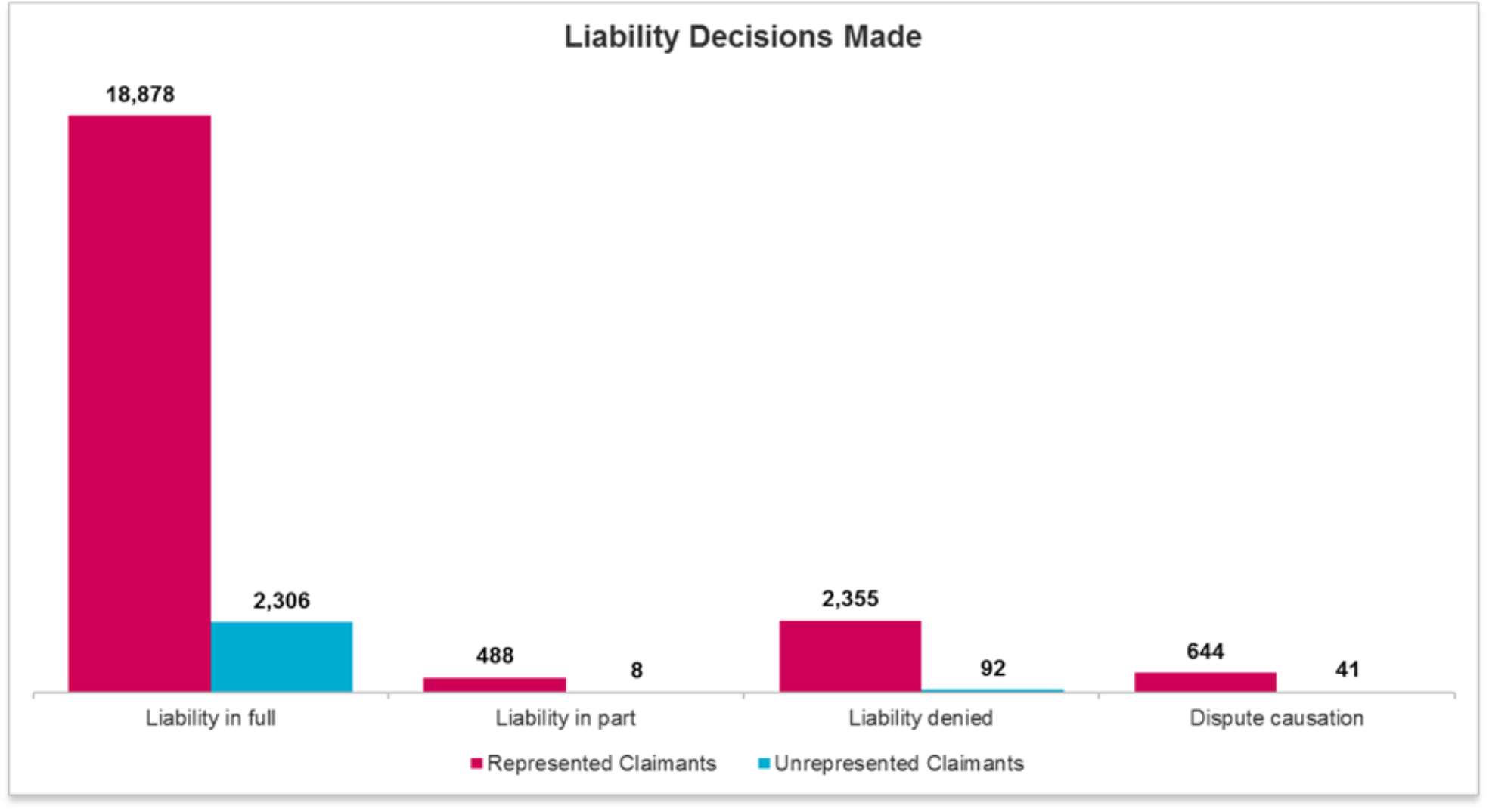

Liability

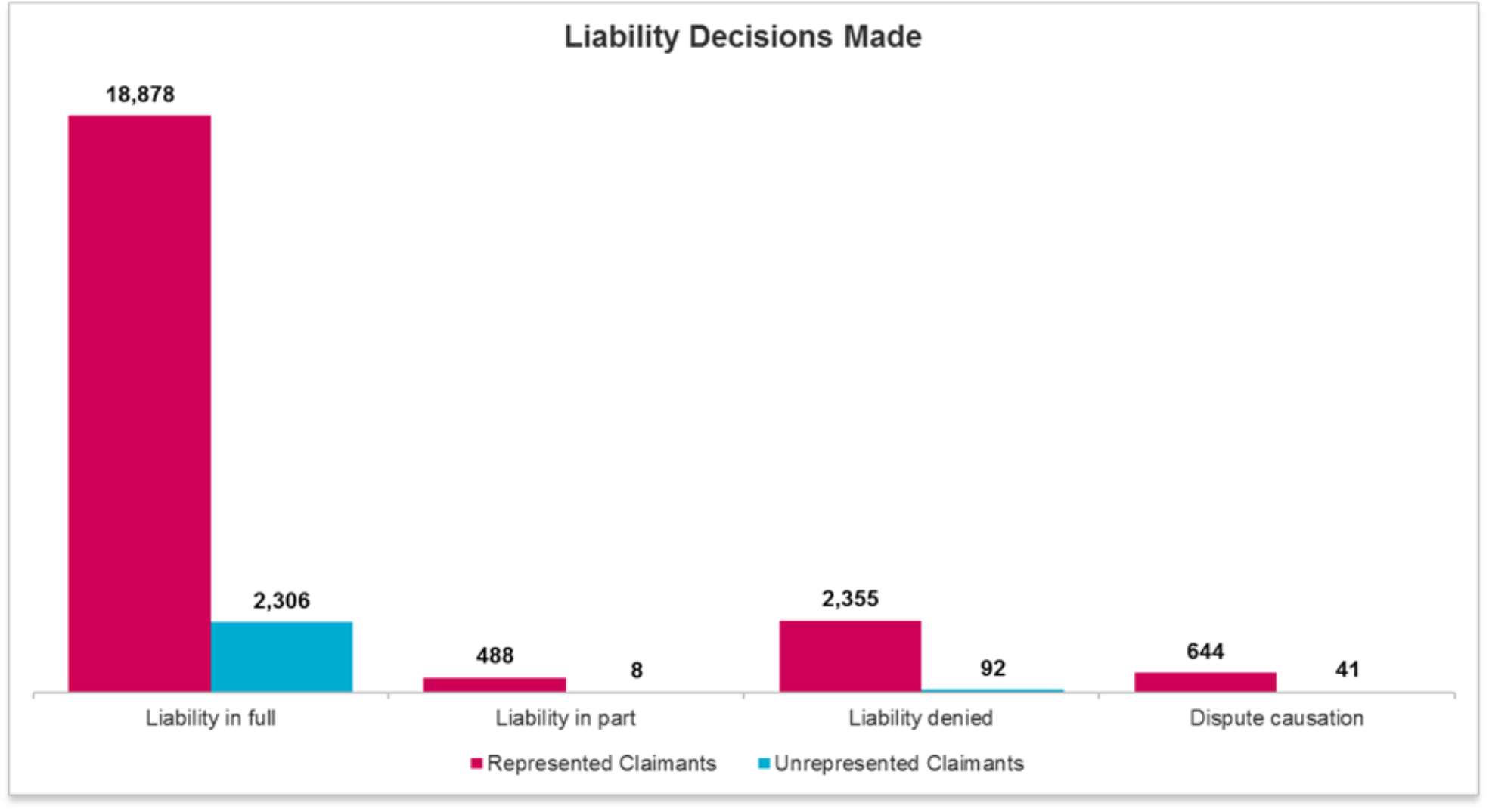

Pretty much half of the cases presented have had a liability decision made by the compensator, with the vast majority of those being admissions.

24,812 have had a liability decision made and of those 21,680 were admissions. 2,447 claims received a full denial. 84% of liability decisions for represented claimants were admissions, rising to 95% for unrepresented. Causation was disputed in 685 claims, 3% of represented claimants and 1% of unrepresented claimants.

Much has been made of the number of claims awaiting a liability decision however this is somewhat disingenuous. What this basic analysis ignores is that the first two months were hit by submission problems from claimant firms so the third month of the quarter is likely to have contained a disproportionate number of the new OIC SCNFs. Therefore many of the claims included within the data will still be within the 30 day liability decision period.

The important statistic is that we are seeing insurers fully repudiate liability in less than 10% of cases. This number is lower for unrepresented claimants but again to put this in context, with the ban on pre-med offers a significant number of those are likely to be non-fault claimants who have been assisted by the third party insurers and directed to the portal to present their claim. This would of course skew the liability figures.

Settlements

Up to 8 September 436 claims had settled, with 96% being unrepresented. It is our understanding that the driver behind this is the relatively slow speed of submission of medical evidence by claimant representatives. Insurers are unable to settle claims which have yet to be presented.

It remains to be seen if there are any other long term factors which lead to a longer lifecycle for represented claimants, such as a higher presentation of additional medical reports. That may well prove to be the case.

Claims exiting portal

Only 6% of claims submitted have exited the portal for a reason other than settlement, with the vast majority of these being removed from the process by the compensator. The range of reasons given include the value being over the threshold, and claims where there is a firm allegation of fraud following receipt of the medical evidence. Close attention should be paid to the volume of claims exiting the OIC for a reason other than claim value. The rules do not allow for claimants to drop the claim for reason of complexity etc. and compensators should closely monitor any adverse behaviour in this regard.