On 26 September 2024 the Government Actuary Department ('GAD') published the outcome of its review of the Personal Injury Discount Rate ('PIDR') in Northern Ireland and Scotland, increasing the rates in both jurisdictions with almost immediate effect from 27 September 2024. Now, after years of uncertainty and speculation, we have a clearer picture of where the PIDR for England and Wales may land.

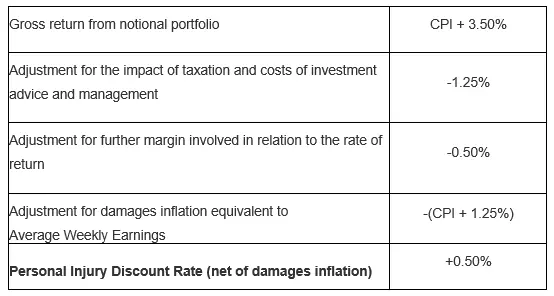

The headline return from the notional portfolio was 3.5% over Consumer Price Index ('CPI') with deductions of 1.25% for tax and advice, 0.5% margin of prudence and 1.25% for the extent to which dmages inflate above CPI.

We now have certainty of discount rate in two of our three jurisdictions. The review in England and Wales started on 15 July 2024 and the rate must be set by 11 January 2025. The GAD reports give us a fairly strong indication of what the rate might be.

There has been extensive consultation on whether the single rate should be replaced by a dual rate system, but the advice on the rate in Scotland from GAD in March 2024 was that “A single rate is still appropriate – stakeholders are concerned about the introduction of a multiple rate system, due to the added complexity and the need for a transition period. A dual rate system may be appropriate, but we expect that further evidence and analysis would be required, and may not be possible to achieve in the current timeframes.” The fact that GAD has continued with a single rate in Scotland and Northern Ireland leads to the inevitable conclusion that we will end up with a single rate in England and Wales as well.

The starting point for what the rate will be is based on modelling a 43 year return on a notional investment portfolio and the result will be significantly affected by what investment returns are at the time it is carried out. The Institute of Actuaries Ogden Working Party has periodically carried out modelling of returns, and since 2022 the expected return has been between 1% and 2% higher than it was in 2019. The overall trend has been towards a positive rate. This prediction of an increase on investment returns was validated by GAD's advice to the Isle of Man Treasury Department on 7 July 2023. They commented that UK government bond yields had increased significantly in 2022 and 2023, offsetting the previous 10 years of falls, such that they recommended a PIDR in the Isle of Man of 1% to 1.25% higher than their advice in 2019. This resulted in the PIDR in the Isle of Man being revised upwards (from -0.25%) to +1% on 10 November 2023.

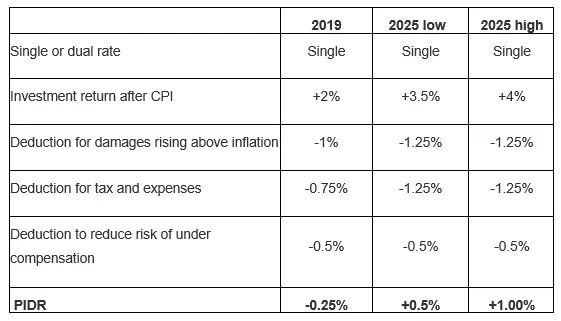

The GAD reports of 26 September 2024 are based on modelling carried out on 31 March 2024 and represent the most recent assessment of the return at the present time. The headline return was found to be 3.5% above CPI. Back in 2019 the return in England and Wales was only 2% above CPI, so on that basis the PIDR would move up by 1.5%. However, for Scotland and Northern Ireland, GAD has concluded that the deduction for tax and expenses should increase to 1.25% from 0.75% and that damages inflation is 1.25%, rather than 1% as allowed in 2019. It is likely that the same assumptions will have been adopted in the England and Wales review.

The reports in Scotland and Northern Ireland do not directly translate across to England and Wales, but bearing in mind the review in England and Wales started in July 2024, it is likely that the modelling carried out by GAD on the headline return will produce a figure very close to the 3.5% above CPI produced by the modelling in March 2024. However, the notional portfolio used in Scotland and Northern Ireland is more cautious than the portfolio in England and Wales*. In 2019 the slightly riskier portfolio in England and Wales produced a headline return 0.5% higher than in Scotland. It is therefore possible that the headline return in England and Wales will again be 0.5% higher than in Scotland (so 4% above CPI) which would indicate a PIDR for England and Wales of +1%.

If GAD adopts the same assumptions as to deductions for England and Wales as it did for Scotland and Northern Ireland, then the possible outcomes are:

It is worth noting that, unlike in Scotland and Northern Ireland, the decision in England and Wales is ultimately one for the Lord Chancellor. There is a possibility that the Lord Chancellor may seek to achieve the same PIDR of +0.5% across all UK jurisdictions to bring the rates into line, which has the benefit of eliminating the current disparity in damages when crossing a border.

Impact on existing cases

The recent change to the PIDR in Scotland and Northern Ireland confirms the prevailing view that returns on investments have been improving since 2019 and that the PIDR in England and Wales will also now turn positive. Our advice is that offers and settlements should now be based on a positive discount rate in line with the above analysis, and a rate of at least +1% should be advanced for the reasons highlighted above.

Consideration should be given to cases on which Part 36 offers have been made but not yet accepted. Unless the offer is expressly withdrawn or varied, a Part 36 offer can still be accepted out of time as long as the claimant is prepared to accept the costs consequences. As there is likely to be a significant increase in the PIDR, some previously unacceptable Part 36 offers could now look quite generous to a claimant and they may be advised to accept out of time. There might also be a few cases where offers by a defendant should be withdrawn or the terms varied. Therefore, current cases involving future losses where Part 36 offers have been made should be reviewed with some urgency.

For cases due to go to trial before January 2025, we consider it unlikely that a judge will grant an adjournment simply on the basis that the PIDR will change imminently. However, there are arguments that the judge should be invited to apply a rate other than the current -0.25% as allowed under s1(2) of the Damages Act 1996 or grant judgment with multipliers to be calculated at the new PIDR when it is released.

After years of uncertainty the latest GAD reports help provide useful insight into the possible PIDR for England and Wales. The range of possible outcomes has narrowed significantly and will have an immediate impact on the handling of many high value claims.

*GAD report ‘Setting the Personal Injury Discount Rate: Government Actuary’s Advice to the Lord Chancellor’, Section 6, Investment Portfolios and Returns, 25 June 2019: ‘England and Wales 57.5% lower risk assets and 42.5% growth assets; Scotland and Northern Ireland 70% lower risk assets and 30% growth assets.’

We understand our clients need to anticipate and model all possible outcomes until the new discount rate for England and Wales is published, and we will continue to provide guidance, revaluations and assistance where we can. Please contact us or any of your usual large loss contacts if you would like any further information on these changes.

Author: Michael Renshaw - Head of the Discount Rate Group