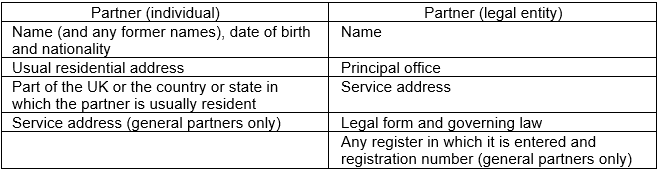

Existing LPs will have six months from the relevant provisions of the Act coming into force to provide this information to Companies House.

The current requirement to confirm the amount of capital contribution of each limited partner will remain.

General partners

No person who is disqualified under the directors disqualification legislation will be able to be a general partner.

General partners will not be able to take part in management of an LP unless notice that they have become a general partner has been filed at Companies House.

General partners that are legal entities (e.g. companies, limited liability partnerships and other entities that are legal persons):

- must register details of a “registered officer”. The registered officer must be an individual, a "managing officer" (which in the case of a company would be a director), not disqualified and must have their identity verified (see below); and

- must register a "named contact" for each of its "corporate managing officers" (if any) (this would apply if, for example, the general partner is a company and one of that company's directors is a company). The named contact must be an individual who is a managing officer of the corporate managing officer.

The details of the registered officer and any named contact must be kept up to date. So, for example, if the person named as the registered officer of a general partner ceased to be a managing officer of that general partner, Companies House would need to be informed and provided with details of a new registered officer.

Existing general partners will have six months from the relevant provisions of the Act coming into force to register the information.

Identity verification is a new requirement that will apply to registered officers but also to, among others, directors of companies and persons with significant control. A person will be able to verify their identity either through Companies House or through an authorised corporate service provider ("ACSP") (e.g. a qualifying body (such as a law firm, firm of accountants or company secretarial service provider) which is registered with Companies House as an ACSP).

Registered office address

Every LP will need a registered office address which is an "appropriate address". This means the address must be:

- an address where, in the ordinary course of events:

- a document addressed to the LP, and delivered there by hand or by post, would be expected to come to the attention of a person acting on behalf of the LP, and

- the delivery of documents there is capable of being recorded by obtaining an acknowledgement of delivery;

- in the part of the UK in which the LP is registered; and

- one of the following:

- the address of the principal place of business of the LP;

- the usual residential address of a general partner who is an individual;

- the address of the registered or principal office of a general partner that is a legal entity;

- an address of an ACSP that is acting for the LP.

Existing LPs will have six months from the relevant provisions of the Act coming into force to register an appropriate address as their registered office address.

Registered email address

Every LP will need to provide Companies House with an email address which it can use to contact the LP.

The email address must be an "appropriate email address" i.e. one at which, in the ordinary course of events, emails sent to it by Companies House would be expected to come to the attention of a person acting on behalf of the LP.

Existing LPs will have six months from the relevant provisions of the Act coming into force to register an appropriate email address.

Confirmation statement

LPs will be required to file a confirmation statement at least once every 12 months. This statement will be similar to the one required to be delivered by companies.

Existing LPs will have six months from the relevant provisions of the Act coming into force to file their first one.

Accounts

HMRC will have the power to require an LP to prepare and deliver to HMRC accounts together with an auditor’s report.

Dissolution

There will be a duty on general partners (or limited partners if there are no general partners) to notify Companies House when an LP is dissolved.

If Companies House has reasonable cause to believe an LP has been dissolved it can (after it has followed a set procedure) deregister the LP. This is similar to the striking off power Companies House has in relation to companies. Companies House may invoke this power where, for example, the LP has failed to file required information on time. Therefore, it is imperative that LPs comply with their filing requirements promptly.

It will also be possible for the partners of an LP to apply to have their LP deregistered.

Delivery of documents

Certain documents relating to LPs will only be able to be delivered to Companies House by an ACSP. This will include, among other things, an application for registration, filings relating to changes of details relating to an LP (e.g. registered office or registered email address and partners) and confirmation statements.

These changes will have a significant impact on LPs. Failure to comply could result in the general partner(s) (and if the general partner is a legal entity, its managing officers) committing a criminal offence and/or the LP being deregistered.

We will be producing guidance on other the changes under the Act prior to their implementation.