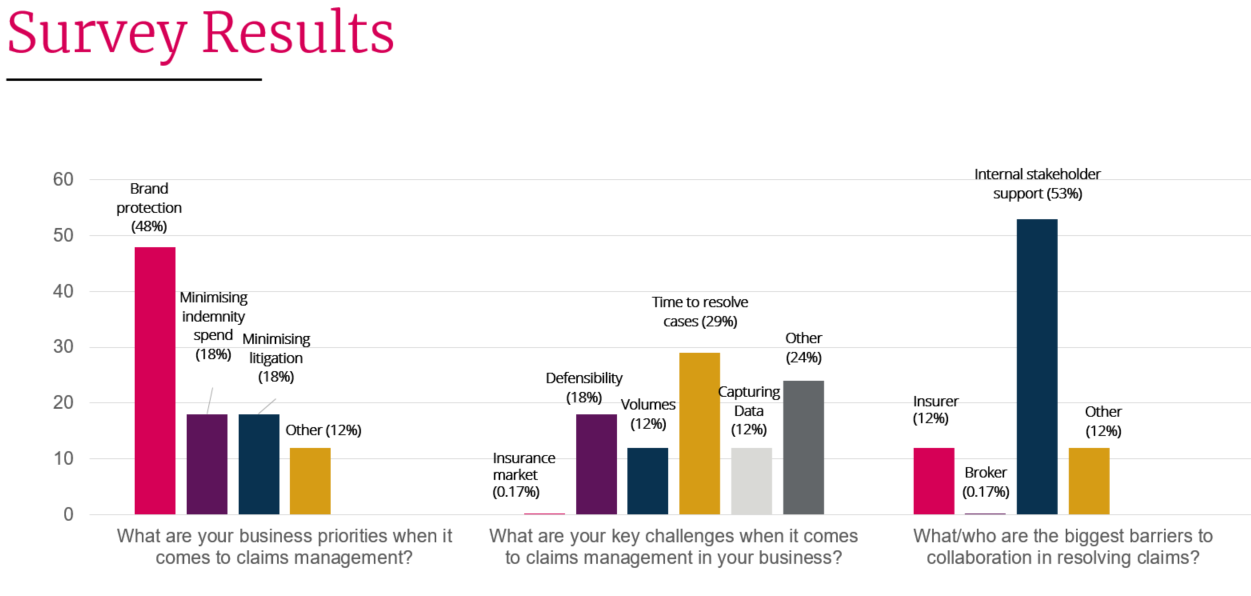

We carried out a survey of corporate insurance managers to better understand the challenges facing insurance leaders in managing volume claims. We asked 3 questions:

- What are your business priorities when it comes to claims management ( rank in order with most important first)

- What are you key challenges when it comes to claims management in your business – ( rank in order with most important first )

- What/who are the biggest barriers to collaboration in resolving claims ( Rank in order with most challenging first)

The responses were telling about the priorities and challenges when it comes to the management of claims within businesses today.

Brand Protection absolutely topped concerns, which is of course far from surprising. Claims can be the most tricky type of interaction with a customer and care is always needed in terms of both overall strategy and the practical way in which claims are managed. In the Consumer sector everyone is a customer or a potential customer, so empathy in any interaction is key, even if you are delivering a rejection. That said we do see differing strategic approaches from clients. Whilst for some brand concerns can translate into a reluctance to ever pursue litigation, even refusing to prosecute clear fraud, for others it can translate into a duty to do so. We would say that balance is key - closing cases quickly and fairly where possible, but picking the right cases to stand firm and not fearing litigation as a tool.

Minimising indemnity spend was another top priority and we recognise this internal pressure just increases year on year. Fundamentally the proactive driving of claims to speedy conclusion is the key here, whether by utilising early offers or making firm repudiations backed by thorough early investigation. We have one client where we have seen claims numbers increase by over 40 % due to underlying business drivers, but we managed to reduce indemnity spend by over 50%. This was achieved by applying a variety of flexible tactics, including proactive claims handling, robust but fair negotiation of quantum, utilising pre-med and early offer tactics, plus review and challenge of supplier costs – including moving one supplier completely.

Another important tool to reduce overall cost of spend is understanding claims data and where leakage really sits. Interestingly this did not pole so highly, but we would always support clients to really dig deep into their data intelligence. The value of data is driven by its accuracy at the front end – the richer and more accurate it is at the outset the better its aids the claims process and feeds learning. Good systems, enabling accurate data capture and analysis, are a critical part to reducing total cost of risk.

Interestingly, when it came to the biggest barriers to collaboration it was not suppliers, brokers or insurers, but the internal workings of business itself. We know internal business stakeholders can bring different perspectives and therefore drive conflicting behaviours. This is particularly so where there are competing internal budgets being asked to address repeat issues or bear the cost of improving defensibility. Claims and legal advisors can often help form a bridge here – bringing an evidence and data based analysis to why a different approach, process change or improved behaviour may be needed.

Ultimately our survey confirmed that the challenges of claims management remain as multi- layered as ever - which means the tactics in response need to continue to evolve in a focused but flexible way.

Would you like to discuss this topic further with in-house legal peers from the consumer sector?

Sign up for our upcoming roundtable: The challenges of effective claims management - reputation, cost management and the power of harnessing claims intelligence

Wednesday 26 January 2022, 14:00-15:00 (GMT)

It is more challenging than ever for businesses with large or complex claims portfolio to reconcile brand protection and managing spend. Join us for a discussion on the ever increasing importance of balancing these competing priorities, the internal and external challenges in doing so and the pivotal importance of good management information and technology.