This article was originally published on the International Islamic Financial Market, you can read it here >

You can also download the PDF report >

Wakalah: Requirements

Wakalah is akin to the agency relationship under the common law and/or civil jurisprudence. Under a Wakalah, a principal, or Muwakkil, appoints an agent, or Wakil, to act on its behalf for the purpose of completing a specific task.

Typically, the Wakalah agreement will include the provisions that deal with: (i) the appointment of the Wakil; (ii) the compensation for the Wakil; (iii) the duties of the Wakil; and (iv) the details of the subject matter of the Wakalah.

The terms and conditions of the Wakil should also be clearly outlined in the Wakalah contract, including his duties and what role he will be playing with respect to the subject matter of the Wakalah. The Wakalah contract should state the duration of the Wakalah, the amount of investment (if any), and under what conditions it will terminate. With respect to remuneration, any profit in excess of the agreed upon profit will be kept by the Wakil as a performance or an incentive fee. It is on the basis that a Sukuk Al Wakalah is structured.

Like other Sukuk, Sukuk Al Wakalah involves the issuance of certificates, or Sukuk. In the case of Sukuk Al Wakalah, the proceeds from the issuance of the Sukuk are utilised to acquire Shari'ah compliant assets or invest in Shari'ah compliant projects or businesses. The Wakil manages the funds in order to generate a profit. However, the amount of profit that is generated pursuant to a Wakalah arrangement is not guaranteed. Sukuk Al Wakalah usually includes an investment strategy (similar to a mudaraba structure) and the Wakil is required to manage the investments in compliance with the said strategy. The profit amount is used to pay the periodic distribution payments to the investors ("Sukukholders") (discussed below). The Wakil is eligible to receive an incentive fee from the amounts in excess of the agreed upon profit.

Discussion of Sukuk Al Wakalah Structure

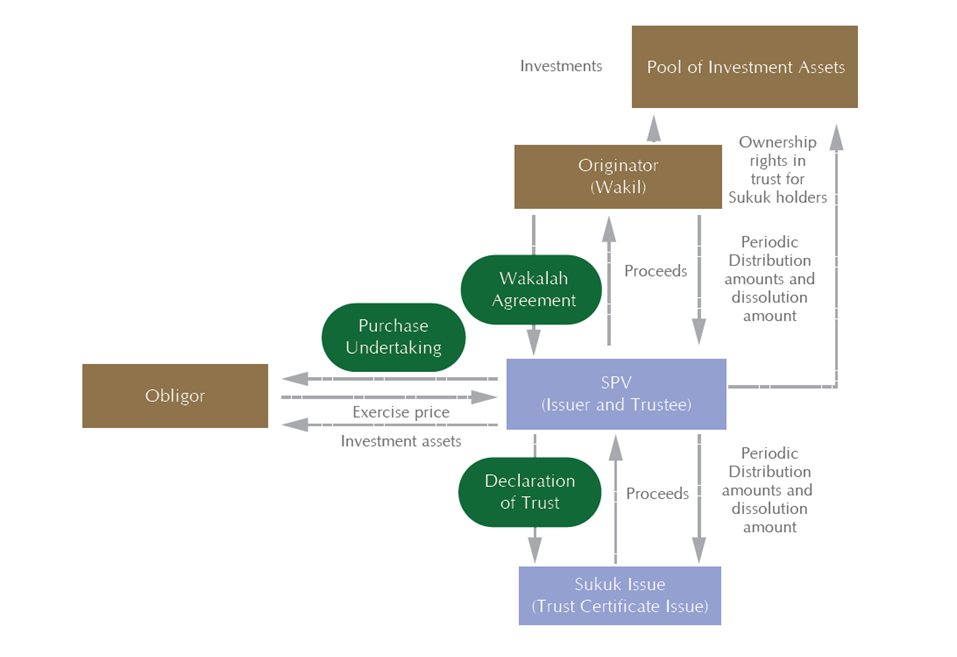

At the outset, the originator of the Sukuk establishes a special purpose vehicle ("SPV") which issues Sukuk certificates to investors or the Sukukholders. The Sukuk represent an undivided interest in the Wakalah assets and grant the Sukukholders the right to periodic distribution amounts.

Separately, the SPV enters into a Wakalah arrangement with the originator of the Sukuk and appoints the originator as a Wakil. The Wakil is appointed to invest the funds obtained from the issuance of the Sukuk in Shari'ah compliant assets or projects, which is usually the business of the originator on behalf of the SPV, and generate profit. The Wakil will remit back to the SPV the pre-agreed amount from the profits earned from investing the Wakalah assets. Any excess from the profit amount will be for the Wakil to keep as an incentive fee.

The profit amount is used by the SPV to pay the periodic distribution to the Sukukholders.

In order to safeguard the Sukukholders' interests, the SPV and the originator will enter into a purchase undertaking whereby the SPV has the right to require the originator to purchase a portion of or all of the Wakalah assets. The exercise price under the undertaking will be equal to the dissolution amount that is payable to the Sukukholders. Generally, the right to require the obligor to purchase the Wakalah assets may be exercised in the event that the SPV does not have sufficient profits to make the periodic distribution amount, if there is a default under the Sukuk transaction, or on the maturity date of the Sukuk.

According to AAOIFI, the purchase price of the Wakalah assets cannot be for a pre-agreed fixed amount and should be subject to the market value of the assets at the time the originator exercises its rights under the purchase undertaking. Shari'ah scholars are of the view that if the originator is required to purchase the Wakalah assets for a fixed amount, the Sukuk holders will not bear any risk with respect to the Wakalah assets and there will be a guarantee of profit for the Sukukholders.

A common work around on the above-mentioned restriction is requiring the originator to act as the guarantor (the "Guarantor") for the amounts due under the Sukuk. The Guarantor will be obligated to make-up any shortfall between the amounts collected from the Wakalah assets and the amounts due to the Sukukholders, whether during the liquidation of the entire Wakalah assets or the periodic distribution payments.

Sukuk Al Wakalah: Documentation

In the context of Sukuk, the standard Wakalah contract is called Al Wakalah Bi Al Istithmar. Under the Al Wakalah Bi Al Istithmar, the Wakil is appointed to invest funds provided by the Muwakkil into a pool of investments or assets, and the Wakil manages those investments on behalf of the Muwakkil for the duration of the contract. The Wakil would usually follow an investment strategy for the purposes of investing the funds and making a return.

Generally, the following documentation will be required in a Sukuk Al Wakalah:

- The originator and SPV will enter into a sale and purchase agreement under which the originator will transfer the relevant portfolio of assets to the SPV, in consideration for a percentage of the Sukuk proceeds. Essentially, it is through the sale and purchase agreement that the originator receives its financing and the Sukuk assets to be managed by it (in its capacity as Wakil);

- A Wakalah agreement will be entered into between the Wakil and the SPV setting out the terms and conditions of the appointment of the Wakil. Pursuant to the Wakalah agreement, the Wakil will be charged with managing the funds generated from the Sukuk in order to generate a return for the Sukukholders.There are also times when the Wakil appoints a sub-Wakil;

- The originator will execute a purchase undertaking in favour of the SPV pursuant to which the originator undertakes that in the event of dissolution or event of default, the originator will purchase the portfolio of assets. By purchasing the portfolio of assets, the originator will provide the SPV with the funds that will allow the SPV to pay the Sukukholders;

- A declaration of trust and/or agency is entered into between the Sukukholders and the SPV stating the issue proceeds to be paid by the Sukukholders to the SPV; and the period distribution amounts and dissolution distribution amounts to be paid by the SPV to the Sukukholders. Under a declaration of trust, the SPV holds a trust over the Sukuk proceeds and assets for the benefit of the Sukukholders and the Sukuk represent the Sukukholders' undivided and proportionate beneficial interest in the trust assets; and

- Sometimes, a guarantee from the originator for the payment of the shortfall between the amounts due under the Sukuk documents and the amounts available under the Wakalah arrangement.

- The rest of the documentation will vary depending on the underlying assets of the Sukuk Al Wakalah. For example, a Murabaha Agreement will be required for the sale and purchase of commodities. The Sukuk proceeds may be invested in a portfolio of Islamic finance transactions, such as Ijara, Istisna and Murabaha.

Sukuk Al Wakalah are growing in popularity as they offer significant flexibility, and can be adapted for the use by various issuers and different asset classes. Given their mutable nature they are continuing to become popular with both the issuers and the investors, and we expect to see an increase in Sukuk issued based on Wakalah structure.

Advantages

There are several advantages to the Sukuk Al Wakalah structure.

- The originator is also the Wakil and therefore responsible for the management of the Wakalah assets, which creates efficiency from an operational perspective;

- The Sukukholders can rely on the expertise of the Wakil in managing the Wakalah assets; and

- The Sukuk Al Wakalah structure allows for the use of a portfolio of assets and investments, so long as 30% of the underlying assets or investments are tangible assets.Therefore, the underlying Wakalah assets can include debt instruments which cannot be traded on a secondary market due to Shari'ah constraints, such as a Murabaha or Istisna contract.