Background

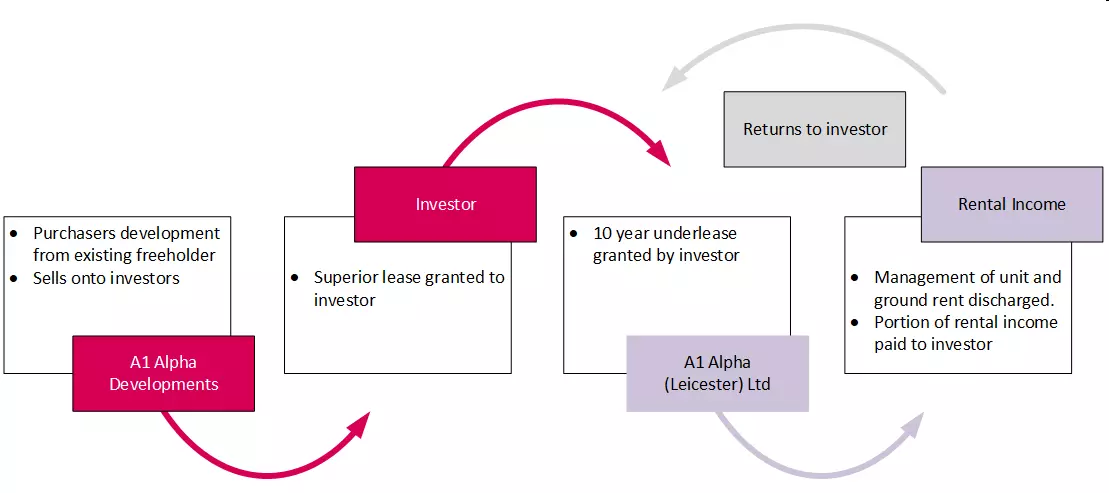

In 2014 the Alpha Development Scheme ("the Scheme") attracted interest from all over the world as marketing material across various platforms promised buyers "effortless" annual returns of 8-10%, as well as guaranteed income. The Scheme offered investors the opportunity to invest in long-leasehold interests in student pods, hotel rooms and holiday apartments, located across the UK in cities including Stoke, Loughborough, Aberdeen and Bradford. Once the investor had completed the long leasehold purchase they would immediately grant an underlease of the property to a management company, A1 Alpha Properties (Leicester) Ltd ("A1"), who were responsible for managing the rooms on behalf of all the investors. The Scheme guaranteed that A1 would pay the investors a monthly income over the underlease period, generated from the rent payments received from the whole development. A1 would also be responsible for discharging the service charges and ground rent payments that the individual investors had covenanted to pay to their landlords in their own long leases of the properties.

After operating successfully for a couple of years, the Scheme unfortunately failed and in October 2018 A1 missed a payment to the investors. A1 claimed that there was not enough money to cover the costs, including ground rent and service charges that were due under the leases and in early 2019 A1 was put into administration.

Having purchased rooms for between £50,000 and £75,000, the investors found themselves being put under pressure to make payment of management fees, service charges and ground rents that they had agreed to pay in their leases without any sums being received from A1 under the underleases to cover these sums.

There is evidence to suggest that over 1500 investors from 50 different countries invested a total of £150 million in the Scheme. Although the Scheme failed in or around October 2018, the directors of the Alpha group companies reportedly earned revenue of upwards of £20 million and Alpha and the Scheme were investigated by the serious fraud office ("SFO"). Although the SFO concluded that there was insufficient evidence to bring charges against anyone for the suspected fraud facilitated by the Scheme, there was a clear suggestion that the Scheme had in fact been fraudulent.

Professional Negligence claims

Since the collapse of the Scheme a number of law firms who acted on behalf of the investors (on the conveyancing aspect of the transaction) are facing claims of professional negligence and it is likely that more claims will be pursued in the near future.

Allegations of negligence include, but are not limited to, the following:

- Failure to warn investors on the structure of the leases and outcome if A1 was to go into administration or fail to make the payments in their underlease;

- Failure to take heed of the SRA Warning Notices relating to Investment Schemes;

- Failure to advise that the scheme potentially constituted an unregulated Collective Investment Scheme and therefore did not benefit from Statutory Regulation; and

- General breach of the retainer and failing to act with reasonable care and skill.

The investors making claims will almost certainly argue that they were "unsophisticated" and had very little knowledge on such investments. Therefore, they relied on their solicitor to warn them of the potential risks of entering into the transaction. As many of the investors were from outside of the jurisdiction it is likely that additional arguments of unfamiliarity with the UK conveyancing process will also be included.

Most investors are looking to recover the amount of their investment, as well as interest and loss of rental income and, as many experts have concluded that the rooms now have nil value and could potentially be subject to a reverse premium, the cumulative quantum in these cases could be substantial.

Defending possible claims and strategy

Although many defendants will almost certainly face litigation risks when it comes to the defence of these claims, we are currently advising a number of law firms on the defence of these claims and are familiar with the various degrees of risk that defendants are facing and the possible defence arguments that can be run. We are therefore in a position to provide expert guidance at an early stage, highlighting the risks that a defendant might face and putting forward possible strategies. Points to consider in defending these claims and possible defences might include:

- Contributory negligence and claims against other parties – arguably the investor was at all times able to sell on the unit that was at the centre of their investment. Indeed, it may be possible to argue that their failure to do so increased their loss as they could have recouped a lot (if not all) of their investment, if the unit had been sold to another party following Alpha going into administration. Did or should the investor obtain advice from an independent financial adviser in respect of the Scheme? We are currently investigating what advice these parties gave and whether we can pursue any contribution claim or advise the claimant should correctly pursue another party.

- What would the response have been to enquiries being raised with Alpha or requests for additional security? Given the SFO's suspicions that the Scheme was set up in order to facilitate a fraud, it is unlikely that Alpha would have been receptive to investors carrying out due diligence and it is highly unlikely that Alpha would have been willing to offer any further protection to the investors in respect of their investment or the returns that they were purportedly due to receive.

- Payment of deposits – although claimants will argue that had they received better advice on the structure of the Scheme then they would not have invested, the payment of not insubstantial booking fees suggests otherwise. In many of these cases investors had already paid a non-refundable reservation fee prior to instructing the defendant solicitor. Arguments can therefore be run that it is highly unlikely that the claimant would have forfeited that sum of money and pulled out of the investment, as a result of the advice they received from the defendant solicitor.

- Aggressive marketing - the involvement of a well-trained and highly persuasive marketing team for the Scheme would have done all that it could to entice the investors to invest in the Scheme in the first instance and then to allay any concerns that they had in order to keep the investor in a position where they were willing to invest. Again, the defendant solicitor could have done nothing to prevent this and/or get the claimant to look beyond the marketing material and really consider whether this was a suitable commercial investment. In any event, there is of course no duty on a solicitor to provide advice in respect of the commercial/economical sense of a transaction or investment.

Well formulated arguments like these could pose significant hurdles for a claimant who is alleging that they relied solely on the advice of the conveyancing solicitor.

Conclusion

As a result of the failure of any investment, it is often the case that professional negligence claims are brought against solicitors by investors as a potential method of recovery following a bad investment. As a general point in all these claims we would be hopeful of convincing a court that the claimant is simply revisiting their poor commercial decisions with the benefit of hindsight and looking for someone to blame. The useful points and arguments set out above forming the basis this proposition.

As with all potential groups of claims we believe that it is essential for defence panel firms and insurers to maintain a consistent approach to the defence of such claims to ensure that the settlement of one claim does not adversely impact on the outcome of other claims and the overall strategy adopted. At DWF we have extensive experience of dealing with group claims and our ability to collaborate with other defence panel solicitors and numerous insurers has enabled us to maintain a robust approach for our insurer clients.

For more information or to discuss issues arising from this article or any possible claims please contact the authors.

Authors: Paul Metham and Rahill Iqbal